You may notice the all milk price, which represents the average gross price farmers received in the given month per hundredweight of milk sold at an average fat test, was not at its lowest in June ($17.90/cwt). In May 2020, during the peak of COVID-19 lockdowns, all milk prices hit $13.60/cwt, their lowest level since DMC became active. Even at that much lower all milk price level, margins were $5.16/cwt or $1.51/cwt higher than they were in June 2023; unworkable but still higher.

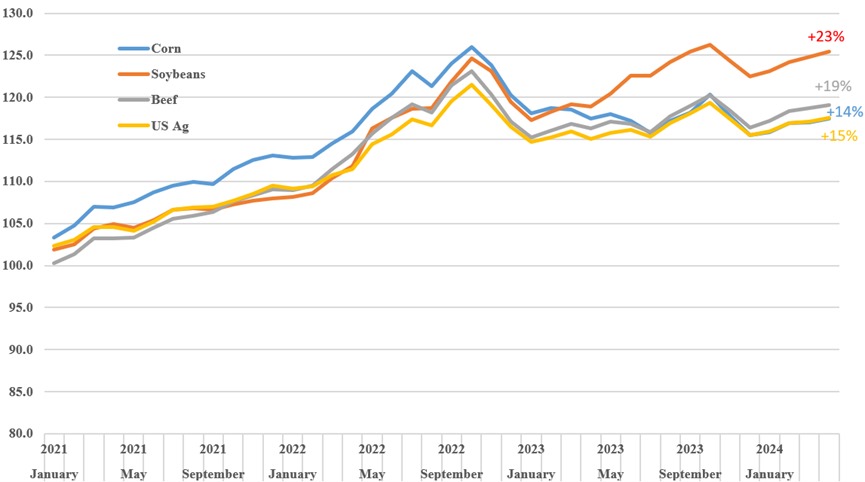

Several factors are at play in the outcome of the June DMC margin. A significant one being feed costs, the basis of the DMC margin calculation, which have remained elevated. The June corn price of $6.49/bu, although down from spring 2022 highs, remains 29% above the 2019-2023 average. Similarly, June blended premium alfalfa costs remain 28% above the 2019-2023 average at $310/ton. Alfalfa values represent the 2021 retroactive adjustment within the feed cost calculation using 100% premium alfalfa hay rather than 50%. Soybean meal costs are a more modest 9% above the 2019-2023 average at $413/ton. Combined and adjusted per hundredweight of milk produced, the Farm Service Agency calculated the June factored average feed cost at $14.25, 24% higher than the 2019-2023 average. These elevated feed costs bite into any price farmers receive, diminishing profit margins. Atop continued uncertainty between Russia and Ukraine, high crop input expenses and unclear harvest expectations, feedstuff prices are expected to remain above average.

Even with high feed costs, total U.S. milk production in the first half of 2023 surpassed 2022 production by 747 million pounds (0.7%). Milk production per cow was up 0.4%, or about 47 pounds during the same timeframe, a testament to the continued improvement of nutrition, genetics and other animal care and production practices farmers have invested in and implemented. Importantly, dairy production includes numerous other inputs and operating expenses not included in the DMC calculation, reducing take home margins further.

In order to buffer against possible price declines, any increase in production must be offset with demand through dairy product sales and consumption. Many U.S. dairy product manufacturers had bet on the American consumer’s growing appetite for cheese, investing in capacity expansions and new plant construction across the nation and particularly the Midwest. Indeed, domestic consumption of cheese since January 2019 has increased 32 million pounds at an increase of about 0.33% each month.

Unfortunately, production from the myriad of new cheese plants across the nation combined with existing stocks and cheese imports are outpacing domestic consumption. Between January and May of 2019, monthly domestic cheese production averaged 653 million pounds. Between January and May of this year, monthly domestic cheese production averaged 694 million pounds, a 6% (42 million pound) increase over the same period in 2019. Average monthly ending cold storage stocks between January and May of this year averaged 629 million pounds, 37 million pounds higher (6%) than the same period in 2019. Cold storage metrics show the end-of-month volume in longer-term (30+ days) cooled storage throughout the U.S. This excess supply depresses the cheese market, contributing to declines in milk prices received by farmers. January to May monthly cheese imports, which make up a much smaller portion of total supply, are up 5% over January-May of 2019 levels, shifting from about 20 million pounds a month to over 21 million pounds a month. Domestic purchases of foreign dairy products further burden the U.S. cheese market.

Click here to see more...