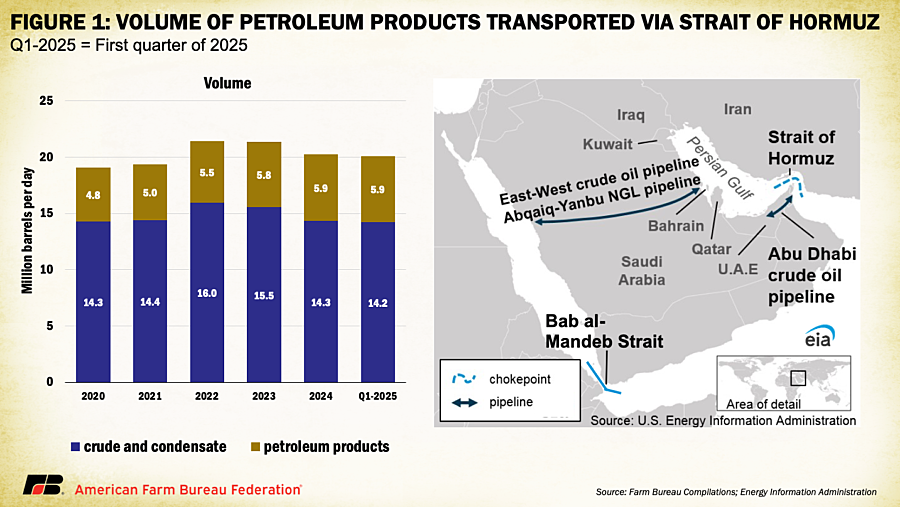

The Strait of Hormuz connects the Persian Gulf to the Arabian Sea and the broader Indian Ocean trade system. At just 21 miles wide, the strait carries an outsized share of global commerce. According to data compiled by the U.S. Energy Information Administration, roughly 14 million to 15 million barrels per day of petroleum, including crude oil, condensates (light liquid hydrocarbons) and refined products, passed through the strait in 2024. This accounted for over 20% of global petroleum consumption, underscoring its centrality in international energy markets.

Saudi Arabia, the United Arab Emirates and Iraq supply the bulk of petroleum volume moving through the Strait. More than two-thirds of the oil and gas flowing through the Strait is bound for Asia, with China, India, Japan and South Korea being top destinations. Any disruption to these flows reverberates globally, causing shipping delays, tightening supplies and pushing prices higher across fuel markets. For U.S. agriculture, this raises red flags, not because the U.S. depends on Middle East oil, but because oil is priced in global markets. Even indirect threats to Hormuz traffic introduce volatility into diesel, gasoline and fertilizer prices for U.S. farmers.

Click here to see more...