By Dr. Kenny Burdine

The last month has been a wild one for the cattle markets. In mid-October, markets seemed to be setting new records each week and shrugging off any bearish news that came along. Things changed quickly in mid-October and much has been written about this in recent weeks. It seemed to begin with a statement by the president about wanting to lower beef prices. Following that statement, markets appeared to latch on to any potentially bearish news, including the potential for increased beef imports and the possibility of resuming live cattle imports from Mexico.

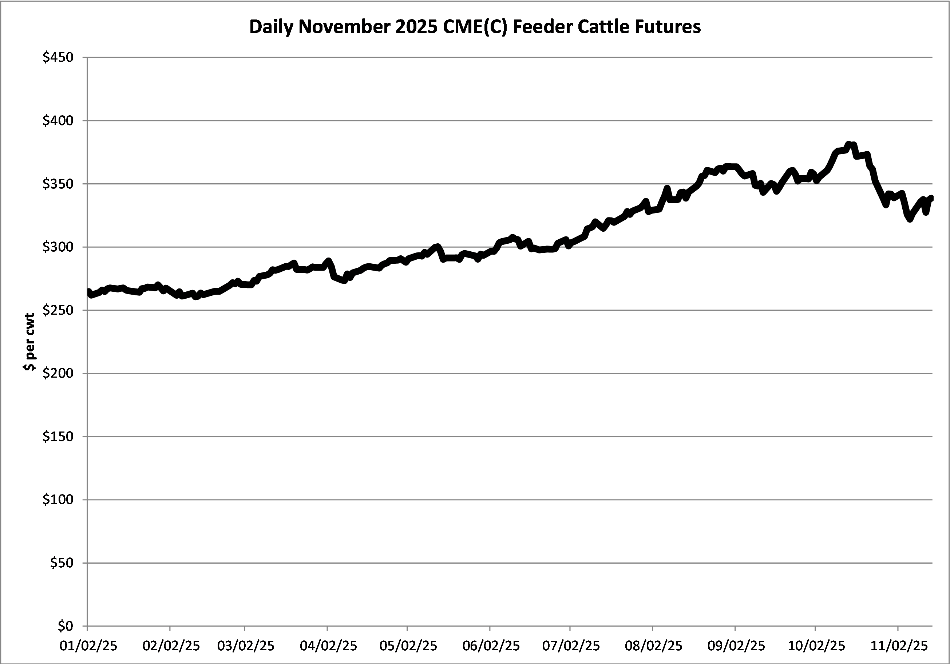

As of the close on Friday November 14th, the November CME© feeder cattle futures contract was down more than $42 per cwt from October 16th. CME© live cattle futures have also fallen sharply, with the December contract down almost $30 per cwt over the same time. In truth, the fundamentals of the cattle market have not really changed. Cattle supplies remain very tight, and beef demand still seems to be strong. Markets discount prices due to uncertainty and that is exactly what they have done over the last few weeks. I think one must also consider that the markets may have gotten a bit too hot and that made them especially vulnerable this fall. For example, by mid-October that November CME© feeder cattle futures price had risen over 43% from where it started 2025 and is still up nearly 28% for the year.