Each producer will make only one AD-3114 application for all eligible crops and livestock. Most likely, farmers will not be able to amend AD-3114 once submitted. As a result, having a complete and accurate AD-3114 when making the submission is important. Missing information on an application could result in a lower payment. Conversely, over-inflating inventories could result in penalties.

What Information for Non-Specialty Crops will be Needed?

Corn, soybeans, grain sorghum and other grain crops fall into the category of “Non-Specialty Crops” on AD-3114. Note that winter wheat grown in Illinois is not eligible for a CFAP payment. For non-specialty crops, two values are needed for each crop:

- 2019 Total Production, and

- 2019 Production Not Sold as of January 15, 2020.

The producer will provide only these values on the application. The producer will self-certify these amounts, and documentation is not needed at the time of application. If a producer is selected for a spot check, documentation will be needed at that time. Two examples are provided below.

Example 1: A farmer has 2019 production of 100% share on owned and cash rent farmland. In 2019, 750 acres of corn produced 200 bushels per acre for a total production of 150,000 bushels of corn. Soybean production occurred on 600 acres with a yield of 55 bushels per acre, for a total production of 33,000 bushels. The farmer sold 26,000 bushels of corn at harvest. No other sales or forwarding contracts were made until after January 15, 2020. This farmer will enter the following four values on AD-3114:

- 2019 Total Production of Corn: 150,000 bushels,

- 2019 Total Production of Soybeans: 33,000 bushels,

- 2019 Production Not Sold of Corn: 124,000 bushels, and

- 2019 Production Not Sold of Soybeans: 33,000 bushels.

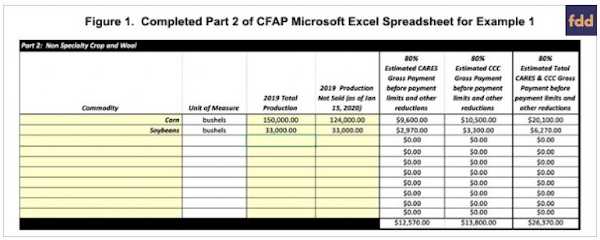

Figure 1 shows the non-specialty crop section from the CFAP Microsoft Excel spreadsheet completed for example 1.

More on the payment determination in Figure 1 can be found in the farmdoc Daily on May 22, 2020. A brief recap is:

- Payment will be made on the lower of 50% of 2019 total production or unsold production on January 15. On AD-3114, 100% of 2019 total production should be entered, as the software will automatically reduce total production by 50% in calculating eligible inventory bushels for CFAP payments. For corn, 50% of 2019 total production is 75,000 bushels which is below the 124,000 bushels not yet sold on January 15. Payments for corn will be based on 75,000 bushels of eligible inventory. For soybeans, 50% of 2019 soybean production is 16,500 bushels, which is again below the 33,000 of production not sold on January 15. Soybean payments will be based on 16,500 bushels of eligible inventory.

- After making all adjustments, payment rates on eligible inventory bushels are $.335 for corn and $.475 for soybeans. However, there will be two installments:

- The first installment is reported in the final column of Figure 1 and is 80% of the total CFAP payment. For corn, the first payment is $20,100 (75,000 eligible bushels x $.335 x .80). For soybeans, the initial payment is $6,270 (16,500 eligible bushels x $.475 x 80%). The total first installment for corn and soybeans is $26,370.

- The second installment is the remaining 20% of the total CFAP payment. This payment will occur if sufficient funds exist.

The above payment estimates do not take into consideration payment limits. Payment limits could reduce CFAP payments.

Example 2: A farmer produced only soybeans in 2019. Production occurred on 500 acres of owned farmland and 400 acres on share rent farmland. The farmer had a 50% share of production on the share rent farmland. In this case, the share rent landowner also is eligible for CFAP payments and would need to complete form AD-3114 separately. Yields were 50 bushels per acre on the owned farmland and 45 bushels per acre on share rent farmland. This farmer’s 2019 production is composed of two parts:

- 25,000 bushels of production on owned farmland on which the farmer has a 100% share (25,000 = 500 acres x 50 bushel yield)

- 9,000 bushels of production on share rent farmland. Total production on the 400 acres of share rent farmland is 18,000 (400 acres x 45 yield). The farmer share is 50%, or 9,000 bushels (18,000 x 50%).

For the farmer, total 2019 production reported on AD-3114 is 34,000 bushels (25,000 bushels from owned farmland + 9,000 bushels from farmer’s share on share rent farmland). If this farmer sold 26,000 bushels at harvest and engaged in no other selling or contracting activity until after January 15, there would be 8,000 bushels of production not sold (8,000 bushels not sold = 34,000 of 2019 production – 21,000 of harvest sales). The farmer will enter the following values on AD-3114:

- 2019 Total Production of corn: 34,000 bushels, and

- 2019 Production Not Sold for soybeans: 8,000 bushels.

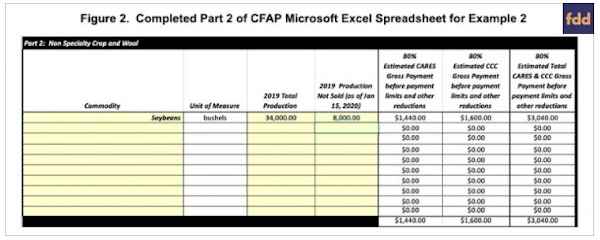

Figure 2 shows a completed AD-3114 for this example. In this case, payment is based on 8,000 bushels of eligible inventory, the 2019 production not sold. The 8,000 is lower than 50% of 34,000 total production (17,000 bushels = 34,000 x .50). The first, 80% installment is $3,040 (8,000 x $.475 x 80%). The second installment, which is not guaranteed is $760 (8,000 x $.475 x 20%).

What is Production Not Sold on January 15?

A key question is the definition of production not sold on January 15. FSA notice CFAP-4 provides the following definition:

- All production, sales, and inventory of eligible commodities and livestock must be subject to price risk as of January 15, 2020. Unpriced inventory or production subject to price risk means any production, sales, and inventory that is not subject to an agreed-upon price in the future through a forward contract, agreement, or similar binding document. The producer’s eligible commodity and/or livestock must still be at risk of price fluctuations after January 15, 2020 to qualify for payment.

Farmers use many types of contracts to price grain that fall into a grey area relative to the above definition. More formal guidance on what types of grain contracts may or may not be included in eligible inventory is expected from Washington, D.C. The following are known:

- Grain must have price risk on January 15.

- Grain sold before January 15 should not be included as “Production Not Sold”.

- Grain sold or priced on January 15 count as eligible bushels.

- Any grain under forward contract on January 15 should not be included as “Production Not Sold”.

Futures contract trading do not impact the determination of unpriced grain. For example, grain hedged by selling and holding a futures contract on January 15 can be included as “Production Not Sold”. Alternatively, a farmer who sold grain and then “reowned” the grain with a future contract should not place the reowned grain as “Production Not Sold”.

How to handle delayed price, basis, and averaging contracts are not known at this time. When additional guidance is provided, this section will be updated.

Will Seed Corn and Popcorn be Included as Corn?

All seed corn and popcorn that the producer still has title and control to is eligible for the CFAP program. Seed corn and popcorn should be entered as corn on the AD-3114 application. All crop swill be included on the application at one time. If there are question about what can or can not be added, you may want to wait to apply for the program.

Seed corn yields are determined in one of three ways.

- If both the commercial crop and hybrid seed crop were grown on the farm and both the commercial and hybrid seed acres were irrigated or non-irrigated, then the yield per planted acre from the commercial acreage is the yield used for the hybrid seed acreage.

- If the producer and company entered into an agreement to use a commercial equivalent yield to calculate payments under the seed contract based on harvested commercial production AND the producer has evidence that the calculation was based on actual harvested yields, then the commercial equivalent production used for payment by the seed company (not to exceed 120 percent of county average yield for the specific year the hybrid seed was grown, as deter-mined by the State Committee/STC) is used.

- If Options 1 and 2 are not applicable to the producer, the county average yield for the specific year the hybrid seed was grown, as determined by the STC, shall be used.

Popcorn is determined the same way as Seed Corn using any of the three options noted above. When an appropriate commercial corn yield is not available on the farm, the producer must divide the pounds of popcorn by 29.7 to get the commercial corn yield in bushels.

What are Payment Limits?

There is a $250,000 per person or per entity limit on CFAP payments.

For sole proprietorships, both the farmer and their spouse can qualify as separate eligible persons/entities if both spouses share in the risk of producing a crop or livestock and both are entitled to a share in the crop or livestock.

Corporations, limited liability companies (LLCs), and limited partnerships can qualify for up to three eligible entities, increasing their total payment limit to up to $750,000. A contribution of at least 400 hours of active personal labor, active personal management, or a combination thereof must be provided by a member, stockholder, or partner from any level of ownership in the organizational structure to qualify the legal entity for the optional increase in payment limitation.

What are the Eligibility Requirements?

The producer must meet the following requirements and have the following documentation filed with FSA to receive a CFAP payment:

- Be a U.S citizen and complete a Farm Operating Plan identifying your farm operation

- (CCC-902).

- Have completed basic records with FSA including identifying members of legal Entitles (CCC-901).

- Be in compliance Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) requirements (AD-1026).

- Have less than $900,000 of adjusted gross income (AGI), on average, for the tax years 2016, 2017, and 2018 (CCC-941). If 3-year AGI exceeds $900,000, 75% of AGI must come from farming (CCC-942).

All entity and eligibility requirement documents must be provided to FSA within 60 days of submitting the AD-3114 application for CFAP.

Summary

While new, the CFAP application process itself will be relatively straightforward. Several issues still need to be clarified. Farmers of non-specialty grains should compile 2019 production and production not sold or priced as of January 15. Eligibility requirements need to be addressed within 60 days of application, and thus should be considered before the CFAP application is submitted.

Source : illinois.edu