| Coverage Level | Subsidy |

|---|

| 95-100% | 35% |

| 90-95% | 40% |

| 85-90% | 45% |

| 80-85% | 50% |

| 70-80% | 55% |

Note: New and beginning producers qualify for an additional 10% subsidy.

LRP insurance for cattle is available for feeder cattle (less than 900 pounds) and fed cattle categories (greater than 900 pounds). The feeder cattle category is further broken down into Weight 1 (less than 600 pounds) and Weight 2 (600 to 900 pounds) classifications, as well as steers and/or heifers. Each of the LRP insurance products connects to a CME contract price with LRP Fed Cattle insurance based on the CME Live Cattle contract price and the various LRP Feeder Cattle insurance products based on the CME Feeder Cattle contract price with adjustments made for weight and sex of the animals.

Some on-farm feeders may be contemplating the need for price protection at this time of year on calves retained with the intent to feed them to a finish weight sometime in 2022, using available feed resources. Despite solid fed cattle prices in the current local market, feed costs and current feeder calf values still make for tight feeding margins moving forward.

Current projections from Purina Mills estimates the cost of gain for feeding a 550-pound steer to a finish weight of 1,400 pounds over the course of 250 days to be $96.23 per cwt. The current average auction price for 500-600 pound steers in Nebraska is $176 per cwt. This suggests a break-even price of $127.57 for the 1,400-pound steer in July of 2022. The June and August live cattle contracts on the CME are currently trading for $135.58 and $134.75 per cwt., respectively.

Cattle-feeding enterprises tend to have tight margins, like many agricultural enterprises, due to the competitive nature of the business. Cattle feeders can bid more for inputs when fed cattle prices rise. This increases the price for feeder cattle, in particular, and somewhat increases the prices for feed and other inputs.

In the short run, an integrated farmer-feeder can benefit from this situation if they raise their own weaned calves and their own feedstuffs. Higher fed cattle prices will increase revenue to the farm, without requiring higher cash flows to pay for the purchase of higher-priced weaned calves and feed. However, the weaned calves and raised feed retained into the feeding enterprise also represent lost revenue. The decision to forego the revenue from these intermediate enterprises in exchange for the opportunity to add value through the feeding enterprise also represents additional risk to the whole farm operation. The value of the farm-raised weaned calves and feed inputs are costs to the fed cattle enterprise, making the latter enterprise worthy of additional attention in terms of protecting projected profit margins.

What are the opportunities to protect profit margins on the fed cattle situation using LRP insurance in our example? To answer this question, consider the 34-week LRP Fed Cattle insurance contract available on November 10, 2021 with an ending date of July 6, 2022. The expected ending price is $135.10 per cwt. The highest coverage price available is $134.30 at a producer premium cost of $4.66. This implies an effective floor price of $129.64 per cwt. (coverage price – premium cost).

The basis between the national price and the local fed cattle market adds to this floor price before making the comparison to the break-even price. The basis value is primarily covering transportation costs, so regions close to major processing plants tend to have a basis value between $0 and $4. Regions far from major processing facilities tend to have a negative basis.

It is important to note that regional effects also influence basis values for 500-600 pound steers in the fall. For example, Nebraska cattle are close to major processing facilities. As a result, basis is positive or zero on fed cattle across much of the state. This sounds good, but offsetting this is a strong positive basis on feeder cattle relative to other regions. Our fed cattle price example illustrates a 2021-22 LRP contract at the highest coverage level potentially protects a profit margin of $2 to $4 per cwt. depending on basis and included premium costs.

Several questions naturally materialize from this discussion. One is, “How has the LRP fed cattle insurance program performed in the past?” Another is, “Does it make sense to always insure at the highest coverage price available?” A third question is, “How does the LRP insurance compare to a put option on the CME in terms of cost and functionality?”

Table 2 shows the performance history of an LRP Fed Cattle insurance contract purchased at the highest coverage level in early November each year from 2016-2020, with an ending date on or around July 6 of each year from 2017-2021. The average producer premium over that time span was $4.80 per cwt., with an average coverage price of $109.61 and a corresponding average expected ending value of $111.46. The average actual ending value of $110.39 exceeded the average coverage price and constituted 99 percent of the average expected ending value.

Table 2: LRP-Fed Cattle Performance 2017-21 for a 34-week Contract Purchased at the Highest Coverage Level in early November with an Ending Date On or Around July 6 ($/cwt.)

| Crop Year | Exp. End Value | Coverage Price | Producer Premium | Actual End Value | Net Result | Final Effective Price w/ LRP |

|---|

| 2017 | 96.331 | 95.56 | 5.62 | 117.74 | ($5.62) | $112.12 |

| 2018 | 119.585 | 118.51 | 6.22 | 112.44 | ($0.15) | $112.29 |

| 2019 | 111.987 | 108.06 | 3.38 | 109.03 | ($3.38) | $105.65 |

| 2020 | 117.528 | 115.75 | 4.65 | 93.22 | $17.88 | $111.10 |

| 2021 | 111.873 | 110.15 | 4.15 | 119.52 | ($4.15) | $115.37 |

| Average | 111.461 | 109.61 | 4.80 | 110.39 | $0.92 | $111.31 |

| St. Dev. | 7.441 | | | 8.546 | | 2.892 |

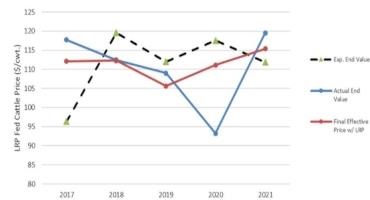

However, these averages mask the positive impact of LRP insurance coverage. Figure 1 is a graphical representation of the expected ending value, the actual ending value, and the final effective price with the proposed LRP insurance coverage for the 2017-2021 marketing years. The expected ending value exceeded the actual ending value in three of those years from 2018-2020. Only in 2020 did the LRP coverage price exceed the ending value by enough to cover the premium cost. However, the net effect of having this LRP coverage in 2019-20 was significant, adding $17.88 per cwt. to the bottom line. The result is a positive average net result over all five years of $0.92 per cwt. for the proposed level of LRP coverage. This represents a 66 percent reduction in the standard deviation of the final effective price with LRP coverage versus the actual ending values (Table 2).

Figure 1: LRP-Fed Cattle Insurance Results from 2017-21 for a 34-week Contract Purchased at the Highest Coverage Level in early November with an Ending Date On or Around July 6 ($/cwt.)

LRP insurance purchased at lower coverage levels produces some interesting comparisons. As shown in Table 1, the subsidy premium breaks are at differentials of five percentage points. Table 3 provides a comparison of LRP Fed Cattle results for the proposed November to July coverage period at four different coverage levels for 2020-2021. The first coverage level was the highest coverage level available. The second coverage level was the highest level available below the 95 percent coverage level cutoff for a 40 percent premium subsidy. The third level compared was the highest level available below the 90 percent coverage level cutoff for a 45 percent premium subsidy and the fourth level was the highest available below the 85 percent coverage level cutoff for a 50 percent premium subsidy.

In 2020 the actual ending value was $93.22 per cwt., as shown in Table 2. This was $24.308 per cwt. below or 79.3 percent of the expected ending value of $117.528, so all of the selected coverage levels paid an indemnity. In 2021, the actual ending value exceeded the expected ending value, resulting in no indemnities regardless of coverage.

Table 3: LRP-Fed Cattle Averages for 2020-21 for Coverage at Various Levels with Purchase in Early November and an Ending Date On or Around July 6 ($/cwt.).

| Coverage Level | Coverage Price1 | Producer Premium | Net Result2 | Final Effective Price w/ LRP | Producer Loss Ratio |

|---|

| 0.9848 | 112.950 | 4.400 | $6.87 | $113.24 | 2.56 |

|---|

| 0.9413 | 107.950 | 2.525 | $5.74 | $112.11 | 3.27 |

|---|

| 0.8975 | 102.950 | 1.390 | $4.88 | $111.25 | 4.51 |

|---|

| 0.8452 | 96.950 | 0.670 | $2.60 | $108.97 | 4.87 |

|---|

1The average expected ending value was $114.70.

2The average actual end value was $106.37

The producer premium declines at lower coverage levels but so does the coverage price. The effect is a lower net result (indemnity – premium), as coverage level declines. This reflects lower effective levels of protection. However, because producer premiums are so low at lower coverage levels, the producer loss ratios (indemnity/premium) increase as the coverage level declines. This results from a higher rate of return on the producer premium investment at the lower coverage levels. In general, a producer should look at LRP coverage as a mechanism to protect output price and subsequent profit margins from a risk management standpoint. However, some producers make a case for insuring at the lower levels of coverage by focusing on the decision as an investment in risk management protection.

Finally, consider how the proposed LRP Fed Cattle coverage compares to a CME Live Cattle put option. The proposed LRP Fed Cattle coverage applied to 2021-22 has an end date of July 6, 2022. CME Live Cattle contracts are available for June and August. The closest match would be a June contract that would expire approximately one week prior to the LRP end date. Prior to the recent increases in LRP premium subsidy rates, producers often noted that CME put options were less expensive than the comparable LRP insurance coverage. With the new premium subsidy rates, the two price risk management products are very comparable in cost (Table 4).

Table 4: LRP-Fed Cattle Coverage for a 34-week Contract Purchased in early November with an Ending Date On or Around July 6 Compared to CME Put Options Available for the June Live Cattle Contract ($/cwt.)

| LRP Fed Cattle Coverage End Date July 6 | CME June Live Cattle Put Option |

|---|

| Coverage Price | Producer Premium | Floor | Strike Price | Premium | Floor |

|---|

| $134.30 | $4.66 | $129.64 | $134.00 | $4.78 | $129.23 |

|---|

| $132.30 | $3.93 | $128.37 | $132.00 | $3.95 | $128.05 |

|---|

| $130.30 | $3.27 | $127.03 | $130.00 | $3.25 | $126.75 |

|---|

| $128.30 | $2.50 | $125.80 | $128.00 | $2.65 | $125.35 |

|---|

The flexibility to exercise the option any time between the purchase and the expiration of the underlying CME contract is another argument often noted in favor of CME put options. This observation is accurate. LRP insurance operates as a European put option in that the value is determined at the end of the coverage period with no ability to cash out value along the way, while also requiring continued ownership of the cattle. However, if price protection at the end of the feeding period is the goal, exercising the put option early should only be completed with considerable caution.

Source : unl.edu