Summary

The Balance of Trade for U.S. Red Meats and Poultry in 2020

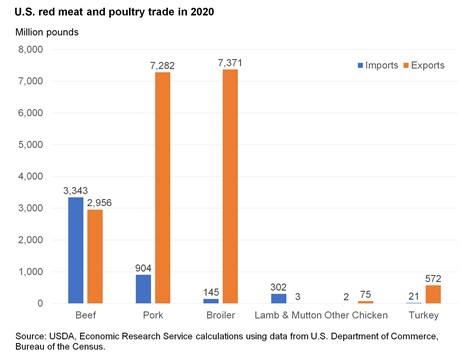

Over the past several years, the United States’ red meats and poultry products have run a trade surplus as the quantity exported has exceeded the quantity imported. The chart below illustrates the U.S. trade balance in red meats and poultry for 2020. By volume, broiler meat was the largest U.S. meat traded in 2020, accounting for 92 percent of total poultry exports and exceeding broiler imports by almost fiftyfold. Pork exports contributed toward the growth in the red meat trade surplus. In 2020, pork exports were sevenfold higher than pork imports, increasing 15.2 percent, or almost 1 billion pounds above a year earlier, on strong Asian demand for pork. In contrast, apart from 2018, the amount of beef imported by the United States has exceeded exports 7 of the last 8 years. Last year, U.S. beef exports declined 2.3 percent from a year ago, while beef imports rose 9.3 percent over the same period. This trade deficit reflects, in part, a robust demand for processing-grade beef. Turkey imports were up 75 percent and turkey exports were down 10.5 percent in 2020, with export levels resulting in a trade surplus for turkey. Other Chicken also had a trade surplus. Lamb imports are far greater than exports.

Pork/Hogs: The March Quarterly Hogs and Pigs report showed March 1 inventories of market hogs and breeding animals below those of March 1 a year ago, as well as lower producer farrowing intentions for the spring (March-May) and summer (June-August) quarters. The winter pig crop and its accompanying litter rate were also year-over-year lower. Lower animal numbers and expectations for lower pig crops later in 2021 are reflected in lower year-over-year pork production in the third quarter (-1 percent below the third quarter of 2020) and in the fourth quarter (-2.5 percent below production in fourth quarter of 2020.) Currently, the March report’s year-over-year lower weight-class categories combine with continued-strong consumer pork demand to push 2021 hog price forecasts higher. Quarterly 2021 live equivalent 51-52 percent lean hog price forecasts average $65.68 per cwt, more than 52 percent higher than a year ago.