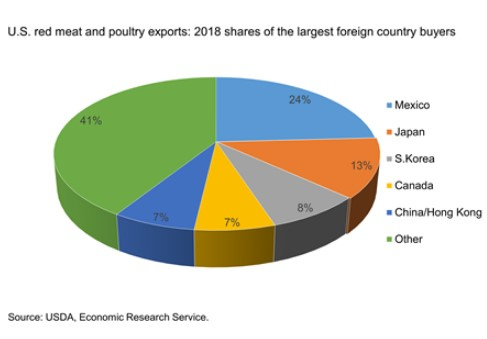

U.S. trade data shows Mexico as the largest single-country buyer of U.S. red meat and poultry in 2018, accounting for about 24 percent of beef, pork, lamb, mutton, broilers, and turkey exported last year. Mexico’s purchases of U.S. animal proteins were spread across red meats and poultry; the country was the largest buyer of U.S. pork, lamb, mutton, broilers, and turkey and the third-largest buyer of beef. Japan accounted for a 13-percent share of red meats and poultry last year. Japan’s export share is weighted heavily towards purchases of U.S. pork and beef—it was the second-largest buyer of pork and the largest buyer of beef. South Korea’s 8-percent share of red meat and poultry exports was also weighted toward red meats; it was the third-largest buyer of pork and the second-largest buyer of beef. Canada’s 7-percent share is accounted for mainly by its purchases of U.S. pork and beef, although it was also the fifth-largest buyer of broiler meat and turkey last year. China\Hong Kong accounted for 7 percent of red meat and poultry exports. It was the fourth-largest buyer of U.S. beef and the fifth-largest pork buyer, but also the second-largest buyer of turkey. A large share of U.S. red meat and poultry exports was distributed in small volumes, across a number of countries that together account for about 41 percent of exports.

Pork and Hogs: The most recent Quarterly Hogs and Pigs report indicated continued growth in the U.S. hog sector, with a record-high March 1 inventory of hogs and pigs. Hog price forecasts were adjusted higher to reflect new information from China indicating important hog losses from African Swine Fever (ASF). January pork exports were almost 2 percent lower than a year ago, dragged down by slower shipments to major markets.

Source: USDA