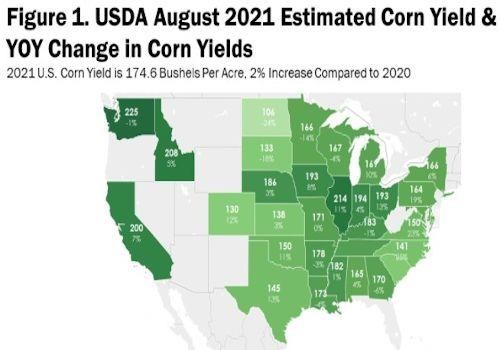

An important note is the year-over-year decrease in expected corn yield for North Dakota, South Dakota and Minnesota, which have all been significantly impacted by drought. North Dakota is expected to have a decrease of 24% in corn yield, going from 139 bushels per acre in 2020 down to 106 bushels per acre in 2021. South Dakota is expecting an 18% decrease in corn yield, going from 162 bushels per acre in 2020 to 133 bushels per acre in 2021. Minnesota reports an expected decrease of 14% in corn yield, going from 192 bushels per acre to 166 bushels per acre.

Figure 1 maps USDA’s August 2021 corn yield estimates and displays the year-over-year change from 2020.

Corn Supply and Demand Expectations

Given the 174.6 bushel per acre estimate for corn yield, USDA lowers production by 415 million bushels in the August WASDE, dropping from 15.16 billion bushels in July to 14.75 billion bushels, which would be a 4% increase compared to 2020. Supply for the 2021/22 corn marketing year will also be increased 35 million bushels due to adjustments made in the 2020/21 marketing year. Ethanol use for 2020/21 was increased by 25 million bushels to 5.075 billion bushels and another 15 million bushels were added in the food, seed and industrial use category to reach 6.5 billion bushels. Exports for the 2020/21 marketing year were reduced by 75 million bushels, going from 2.85 billion bushels to 2.77 billion bushels. The net result is an increase to ending stocks of 35 million bushels, moving from 1.08 billion bushels to 1.11 billion bushels of current marketing year corn that will be carried into the 2021/22 marketing year. The stocks-to-use ratio for the current marketing year moves up slightly to 7.4%, the lowest level since 2012, while the corn price for the current marketing year remains at $4.40 per bushel.

In addition to demand adjustments in 2020/21, USDA adjusted corn demand for the new marketing year (2021/22) by reducing feed and residual use by 100 million bushels to 5.6 billion bushels, but increased food, seed and industrial use by 10 million bushels for non-ethanol use, bumping it up to 6.6 billion bushels. Exports for 2021/22 corn were also reduced by 100 million bushels, going from 2.5 billion bushels to 2.4 billion bushels. The overall impact reduces expected corn ending stocks for the new marketing year from 1.4 billion bushels to 1.2 billion bushels. The stocks-to-use ratio decreased from 9.6% in July to 8.5% in August, while the corn price increased from $5.60 per bushel to $5.75 per bushel, the highest since 2013.

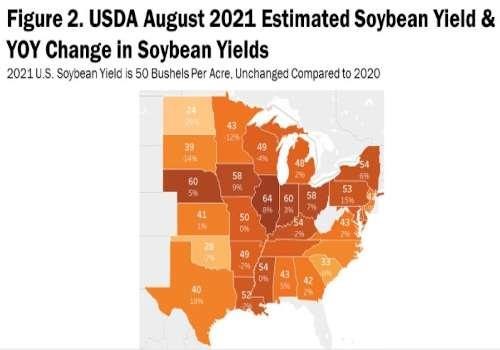

2021 Soybean Yield

Illinois leads the country in estimated soybean yield with 64 bushels per acre, an increase of 8% compared to 2020 when soybean yield was 59 bushels per acre. Nebraska is just behind with an estimated soybean yield of 60 bushels per acre, up 5% from 2020 when soybean yield was 57 bushels per acre. Indiana is also expecting 60 bushels per acre of soybeans, which is up 3% from 2020 when soybean yield was 58 bushels per acre. Texas leads the way with the largest year-over-year increase in estimated soybean yield, 18%, with soybean yields estimated to be 40 bushels per acre, up from 34 bushels per acre in 2020.

Looking at a few of the drought-stricken states, North Dakota is expecting the largest year-over-year reduction in soybean yields across all soybean producing states, decreasing 28% from 33.5 bushels per acre in 2020 to, 24 bushels per acre in 2021. South Dakota is expecting the second-largest decrease, 14%, going from 45.5 bushels per acre in 2020 to 39 bushels per acre in 2021. Minnesota expects a 12% reduction in soybean yields, moving from 49 bushels per acre in 2020 to 43 bushels per acre in 2021.

Figure 2 maps USDA’s August 2021 soybean yield estimates and displays the year-over-year change from 2020.

Click here to see more...