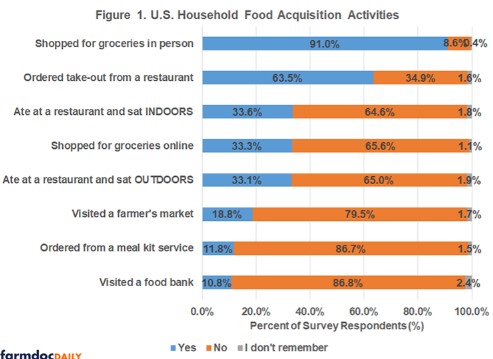

Figure 1 shows the extent to which U.S. households engaged in each food acquisition activity in the last two weeks (which would be approximately the first 2 weeks of September this year).

The results from Figure 1 suggest that, generally speaking, consumers are following the guidance of public health officials, sticking to essential food acquisition activities (grocery shopping) and limiting in-person dining at restaurants (indoor and outdoor), opting for take-out instead. These results are in line with those reported by an industry survey on dining out behavior during the pandemic (Sanchez, 2020).

One thing we do not know from the survey is the frequency that consumers performed each activity during the two-week period. Zagat (2018) reported that consumers ate out 5.9 times per week (including take-out) in 2018. Sanchez (2020) reported that consumers are ordering take-out 2.4 times per week during the pandemic. Given the low proportions of people who reported eating at a restaurant indoors or outdoors, it appears unlikely that consumers are eating out at pre-Covid levels. This conclusion is also supported by data on food spending (Ellison et al., 2020) and restaurant closures during the pandemic (Sundaram, 2020).

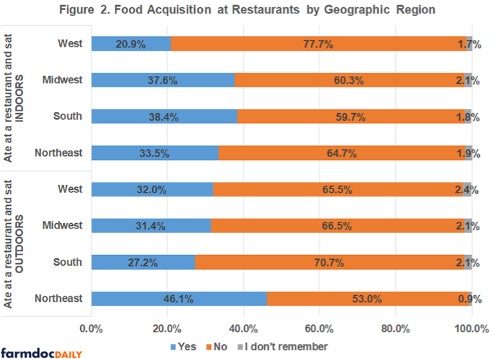

Food Acquisition Activities by Geographic Region

When we compare food acquisition activities by geographic region (following the U.S. Census, we use four regions: Northeast, South, Midwest and West), the biggest differences in food acquisition behavior relate to dining at restaurants (see Figure 2). For indoor dining, larger proportions of consumers in the South and Midwest regions (38.4% and 37.6%, respectively) reported they had done this in the last two weeks. In contrast, only 20.9% of consumers in the West region reported eating indoors during the same period. For eating outdoors, we found that the Northeast region had the largest share of diners (46.1%) who engaged in this activity in the last two weeks.

Weather variation could partially explain some of the differences we see in restaurant dining behavior. In the South and Midwest, the temperatures were likely still quite warm during the data collection period, which may drive more consumers to eat indoors. Alternatively, with outdoor dining, the Northeast region was likely experiencing cooler temperatures, which may have influenced the number of people who wanted to dine outside. It is also important to note that states in the Northeast region were experiencing much lower rates of Covid-19 during the survey period (and the two weeks prior), which could also lead to more consumers feeling comfortable engaging in outdoor dining relative to other regions (The New York Times, 2020).

Outside of restaurant dining activity, we found that consumers in the South were more likely to shop for groceries online relative to other regions (39.6% in the South reported doing this in the last two week vs. 32%, 28.8%, and 27.2% in the Midwest, Northeast, and West, respectively). Further, consumers in the South were more likely to visit a food bank during the last two weeks (15.3% reported doing this) relative to other regions.

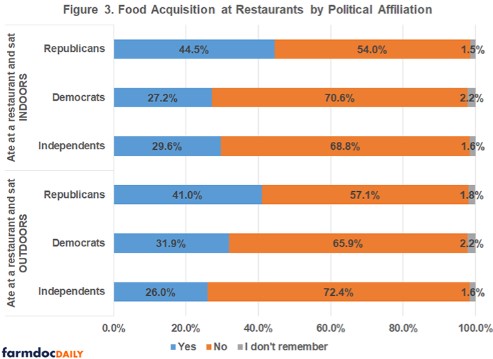

Food Acquisition Activities by Political Affiliation

For data analysis purposes, we group consumers into three categories for political affiliation: Republicans, Democrats, and Independents. In our survey, there were additional response options for “Other” and “No Preference”, but few respondents selected these options, so we grouped individuals who selected these categories in the Independents category.

When we compare food acquisition activities by political affiliation, the only significant differences we see in acquisition behaviors relate to restaurant dining behavior. Figure 3 summarizes our results. For both indoor and outdoor dining, a greater share of Republicans indicated that they engaged in these activities in the last two weeks relative to Democrats and Independents. This result does not appear to be driven by any particular geographic region. The share of Republicans who reported engaging in each of these activities was greater than the shares for Democrats and Independents in each of the four regions. These results may provide one indication that the pandemic has evolved into a partisan issue, or that it is evolving into one, though it is difficult to draw definitive conclusions from one sample at one point in time.

Conclusion

The Covid-19 pandemic continues to have a clear impact on how households acquire food. Broadly, we find that consumers continue to shop for groceries in person, but dining at restaurants (indoors or outdoors) does not seem to be an activity that the majority of consumers are engaging in right now. There are some differences in food acquisition behaviors by geographic region and political affiliation, particularly when it comes to restaurant dining behavior.

Source : illinois.edu