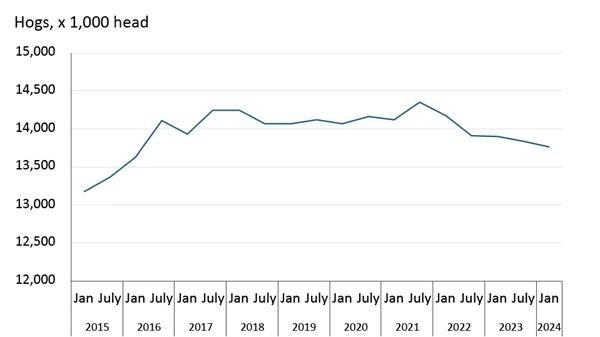

Figure 1: Canadian hog inventories on the way down

Source: AAFC

Although our 2024 outlook indicates Canada’s hog sector isn’t completely out of the woods yet, the year is breathing some life back into hog production. We last provided an outlook for the hog sector in January, when we forecasted 2024 prices to stabilize or rise year-over-year (YoY). That was a welcome sign then, and it continues to hold now in July (Table 1).

Table 1: Hog prices remain elevated in July throughout the outlook period

Livestock prices | 2024 forecast | 2023 average | 5-year average |

|---|

Ontario market hog $/kg | 2.30 | 2.20 | 2.10 |

Ontario feeder hog $/kg | 2.10 | 2.00 | 1.90 |

Manitoba market hog $/kg | 2.25 | 2.25 | 2.10 |

Manitoba feeder hog $/kg | 2.05 | 2.05 | 1.90 |

Isowean $/head | 40 | 45 | 50 |

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Better prices in 2024 on average

All price forecasts for the current year (except isoweans) are higher than their respective five-year averages. But there’s some good news for isoweans too: their price has risen since January. Hog prices have, overall, risen then stabilized in 2024, in part, as a result of the improving balance in hog supplies.

Pork producers can also thank their partner in red meat markets for helping to boost pork sales. For at least a year, it’s been the most economical meat option of the big three meats (beef, pork and chicken). Consumers are still buying beef at high prices, but we can safely assume there’s some substitution effect too: for some red meat buyers, beef is simply out of reach, and they’ll substitute pork instead. Canada’s Consumer Price Index shows the largest price gains in 2024 have, in fact, come from pork, but that may not matter much to what Canadians actually buy.

Click here to see more...