By Nick Paulson and Gary Schnitkey et.al

Fertilizer prices have continued their more than year-long decline through the first two weeks of August 2023. On a per pound of nitrogen basis, urea and liquid nitrogen fertilizers have historically been priced at a premium of 35% to 40% above anhydrous ammonia. However, the premium narrowed in 2022 as global fertilizer markets were disrupted by the Russia-Ukraine conflict. The premium on liquid, relative to anhydrous, has returned to more historical levels while the gap has continued to narrow between urea and anhydrous prices. This is attributed to continued expansion in global production capacity combined with lower demand prospects, particularly in Europe, where legislation aimed at improving air quality may further reduce urea use. The major decline in fertilizer prices in general, and the attractiveness of urea in relative price terms specifically, may impact farmers’ nitrogen decisions leading into the 2024 crop year.

Relative Price Gaps Narrow as Fertilizer Prices Continue to Decline

Fertilizer prices in Illinois continued to decline in the first half of August 2023, according to the Illinois Production Cost Report from the U.S. Department of Agriculture (USDA). The average anhydrous ammonia price reported for August 10th was $586 per ton, down $285 per ton since July 27th, a decline of 33%. Liquid nitrogen fell 26% to $397 per ton, down $140 per ton, over the same time period. Urea saw a moderate decline to $473 per ton, down $24, a decrease of 5%. These price declines continue a more than year-long period of falling fertilizer prices from peaks reached in the second quarter of 2022 (see farmdoc daily articles from August 1, 2023 and February 28, 2023).

Figure 1 reports average Illinois prices for anhydrous ammonia, urea, and liquid nitrogen on a $ per pound of nitrogen basis since the start of 2020. The price calculations are based on nitrogen contents of 82% for anhydrous, 46% for urea, and 28% for liquid.

Both liquid nitrogen and urea have typically been priced at a premium per pound of nitrogen relative to anhydrous due to the additional processing costs associated with their production. The premium on liquid nitrogen, relative to anhydrous, has persisted since 2020. In contrast, the premium on urea narrowed for much of 2022, and the prices of anhydrous and urea have been very similar on a per pound of N basis so far in 2023.

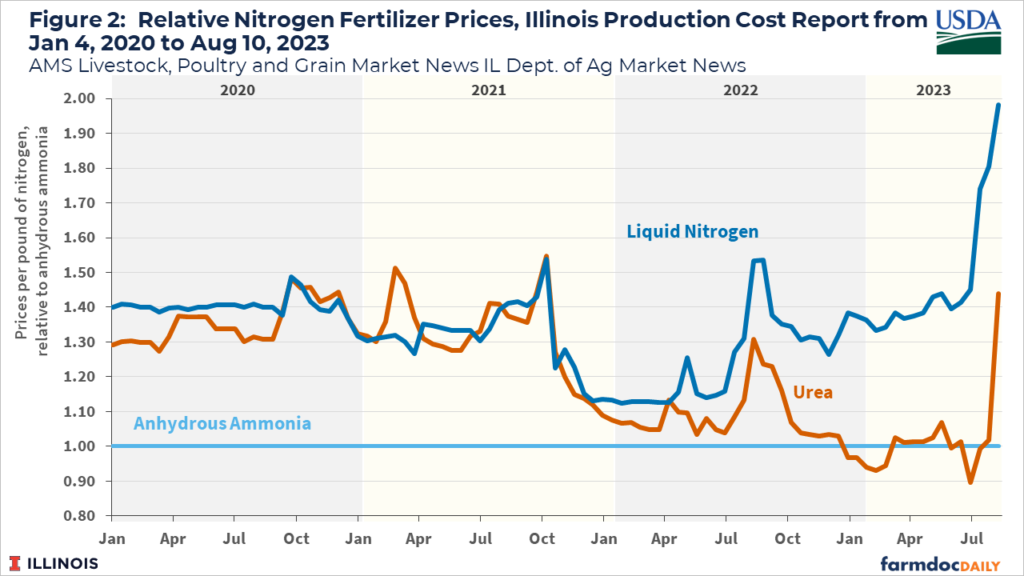

Figure 2 reports urea and liquid nitrogen price ratios relative to anhydrous. For example, from 2020 through September 2021, urea prices averaged 36% higher than anhydrous, while the premium on liquid averaged 38%. From October 2021 through July 2022, the average premium on urea declined to just under 10% and the premium on liquid averaged 17%. Over the past year, the premium on urea has averaged just 3.8%, with many reporting dates indicating average urea prices below anhydrous ammonia on a per pound of nitrogen basis. The premium on liquid returned to an average of about 40% over anhydrous ammonia from August 2022 to mid-July of 2023.

While it only represents a single two-week reporting period, the latest price decline on nitrogen fertilizer products from July 27th to August 10th would put the urea premium back in the range of 40%. The liquid premium has risen from around 40% to 98% since the end of June.

Much of the narrowing in premiums on urea and liquid relative to anhydrous in the first half of 2022 is linked to the Russia-Ukraine conflict, as there were significant disruptions and displacement of global fertilizer trade flows (see farmdoc daily from April 26, 2022). The more extended narrowing of the gap between urea and anhydrous prices can be attributed to the planned expansion of urea production capacity as well as weaker global demand. India, already the world’s leading urea producer, intends to continue to expand domestic production with an aim to remove all dependence on imports by 2025.

The price spikes in 2022 reduced demand for fertilizers globally, particularly in Europe, where they experienced significant energy price spikes and are heavily reliant on imports from the Black Sea countries of Russia and Belarus for their fertilizer needs. Moreover, legislation in the EU targeted at reducing emissions and improving air quality may lead to requirements for using inhibitors with a fertilizers such as urea, resulting in uncertain demand prospects moving forward.

Summary

Fertilizer prices in Illinois have been consistently trending downward for more than a year after peaking in the second quarter of 2022. On a per pound of nitrogen basis, the gap between anhydrous, urea, and liquid nitrogen prices narrowed in 2022. The premium on liquid nitrogen has since returned to more typical historical levels, but the premium on urea relative to anhydrous has remained historically low through July 2023. This has been attributed to the Russia-Ukraine conflict and associated market disruptions, expanding global production capacity, lower demand due to the high prices last year, and negative demand prospects for urea based on possible air quality legislation impacts in Europe.

The continued decline in fertilizer prices improves return and income prospects as we look ahead to soon-to-be-released crop budgets for 2024. If the low premium on urea relative to anhydrous extends into the coming months, it may make urea a more attractive nitrogen option for farmers in 2024.

Source : illinois.edu