By Josh Maples

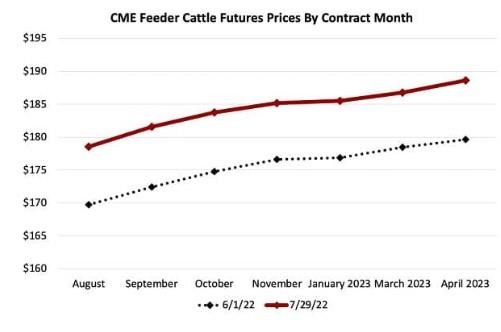

Last week, James discussed the July Cattle Inventory report and the tightening supplies of cattle. Tighter supplies are expected to be a main driver of stronger cattle prices over the next few years. The December Corn futures contract is down more than $1 per bushel since mid-June which also has a positive impact on cattle market expectations. In this week’s newsletter, we’ll look at Feeder Cattle futures markets.

The CME Feeder Cattle futures contracts reflect expected prices per hundred weight (CWT) for 700-899 pound feeder cattle within a 12 state region that includes the bulk of feeder cattle sales. There are separate contracts for different months in the future. For example, the “nearby,” or closest to expiring, contract is the August 2022 contract. However, there are also other feeder cattle contracts currently trading, with the only difference being the expiration month.