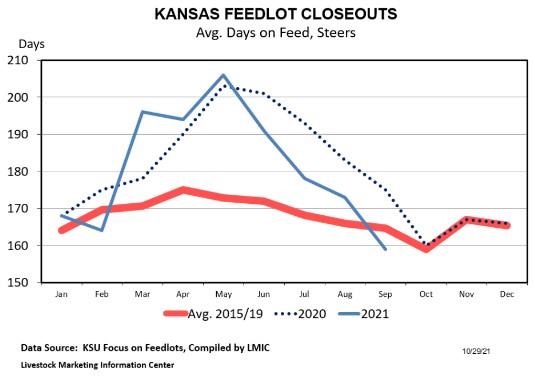

There are also dynamics related to fed cattle supply and marketings that are just as important to understand. We had previously talked about the pandemic pushing some 2020 cattle supplies into 2021 and how that had improved over the course of the current year. But, we are now seeing additional signs that feedlots are getting more current. The combination of fewer cattle on feed and much higher feed prices is leading to decreases in the number of days that cattle are on feed. Notice in the chart below how sharply “days on feed” has dropped since May in the Kansas State Focus on Feedlots data – this is way beyond what is seasonally normal. The more current feedlots are, the more leverage they have as they sell fed cattle into the packing industry, which explains some of the recent price improvement in slaughter cattle markets.

Fundamentally, current fed cattle prices should have little direct impact on feeder cattle values since feeder cattle are several months away from harvest. But a strong fall fed cattle market certainly creates optimism for spring, and the expectation of spring fed cattle prices is impacting feeder cattle prices now. On Friday November 5, CME© Live Cattle futures for April 2022 settled right at $140 per cwt. This was roughly $8 per cwt higher than the December contract, which is the current CME© live cattle contract being traded. Even contracts for the summer months are trading above that December price. Put simply, it appears that dynamics have shifted such that fed cattle prices should be much stronger in 2022 and that is welcome news for feeder cattle markets.

Source : osu.edu