While recent trade frameworks provide optimism for increased exports and market access, products have yet to move in significant volumes and cash prices for commodities such as corn, soybeans, wheat and cotton remain under pressure and are at or well below levels experienced at the beginning of the year. For farmers who had to sell at harvest price lows due to the lack of storage, the benefits of recently announced trade frameworks will come too late.

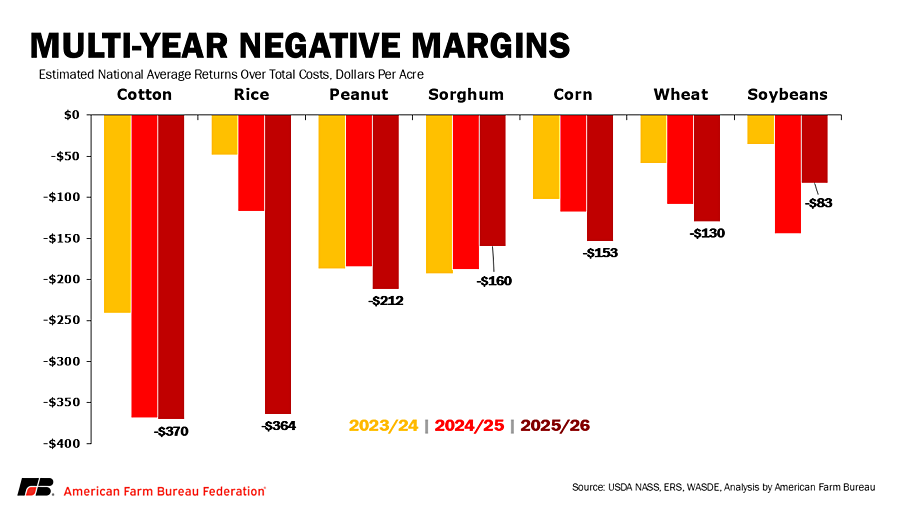

Due largely to the Chinese falling short of their Phase 1 commitments, and more recent trade uncertainty, farmers across the Corn Belt pulled back on soybean acres and instead planted nearly 100 million acres of corn. At an average total cost (including fixed and variable operating costs) of putting the crop in the ground of approximately $900 an acre, corn farmers committed nearly $90 billion to sow a crop this spring. Now, even with an expected record yield of 186 bushels per acre and a $4 per bushel national average price, the return over total cost is estimated at a loss of over $150 per acre, with total losses nationwide eclipsing $15 billion.

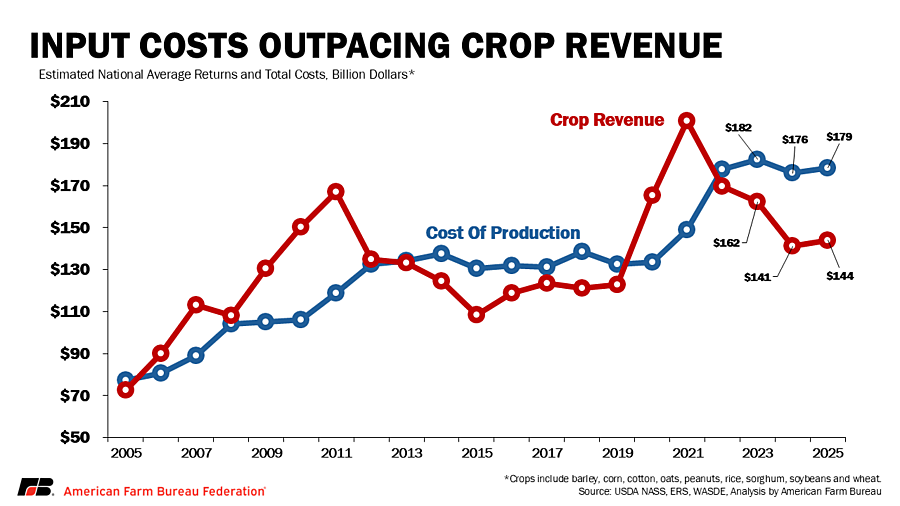

The math is the same for every major crop as well as specialty crops and it’s been that way for several consecutive years, with combined annual returns below total costs (for nine principal crops) from the 2023/24 to 2025/26 crop years at -$20.2 billion, -$34.8 billion and -$34.6 billion, respectively, and before crop insurance indemnities and other support.

Click here to see more...