The debt limit barrier to a farm bill has been removed, which may increase the odds that Congress can reauthorize a farm bill this year but certainly doesn’t guarantee it. A collision between expectations for farm program payments and the rules governing a farm bill budget could be among the most significant barriers remaining. This article reviews some of what may be driving expectations for farm program payments and the challenges that result.

Background

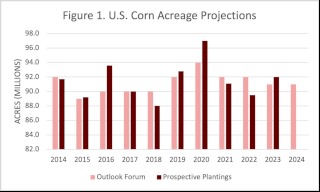

Congress reauthorized the direct farm income assistance programs in Title I of the Agricultural Improvement Act of 2018 (P.L. 115-334), including the primary payment programs Agriculture Risk Coverage, County Option (ARC-CO) and Price Loss Coverage (PLC) first authorized in the Agricultural Act of 2014 (P.L. 113-79). At the time of its enactment, CBO projected that ARC-CO and PLC would spend $72.6 billion over fiscal years (FY) 2019-2028 (CBO, December 11, 2018). In the May 2023 baseline, CBO projected outlays for ARC-CO and PLC during FY 2019 to FY2028 totaling $33.5 billion; this includes a total of $14.25 billion for FY 2019 to FY 2023, which compared to the 2018 projection of $36.8 billion for those years (CBO, May 2023; farmdoc daily, March 2, 2023). Figure 1 compares the CBO projections for ARC-CO and PLC as scored for the 2018 Farm Bill (line) with the reported outlays since enactment, as well as the May 2023 baseline projections (bars). The low projections for FY 2023 through FY 2025 are particularly notable and relevant for the pending farm bill debate.

On its own, the decline in actual and projected spending would present challenges for a farm bill reauthorization debate because it reduces the baseline for Title I. The scale and scope of federal payments for farmers since the 2018 Farm Bill was enacted, however, magnify those challenges. Figure 2 demonstrates the issue by illustrating the total payments reported for ARC and PLC and those payments for ad hoc or supplemental programs from FY 2018 to FY 2021, as well as the forecasted spending in FY 2022 and FY 2023. The ad hoc and supplemental programs included are the Market Facilitation Program (MFP), the Coronavirus Food Assistance Programs (CFAP 1 and 2), as well as other non-pandemic related supplemental assistance.

At the time they were reauthorized in 2018, ARC-CO and PLC were expected to pay over $7 billion to farmers in each of FY 2023 through FY 2025, which would encompass crop years 2021 through 2023. CBO now projects total spending below $500 million from those programs in those years. More importantly, that reduction in spending follows in the wake of record payments to farmers from ad hoc and supplemental assistance programs. USDA forecasts less than $100 million in payments for FY2023 from ARC and PLC, compared to nearly $6 billion in ad hoc and supplemental programs. If realized, this would amount to a fraction of the 2020 payments that were more than $6 billion from ARC and PLC and over $35 billion from ad hoc and supplemental.

Discussion

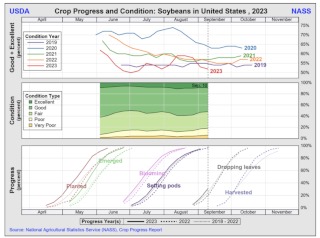

The cause of the reduced ARC-CO and PLC payments is straight-forward: crop prices and revenues have been relatively higher in recent years. Figure 3 presents an overview. First, it illustrates the financial indicators for the farm sector as reported by USDA’s Economic Research Service for 2016 through the 2022 and 2023 forecasts (USDA-ERS, Highlights from the Farm Income Forecast, February 7, 2023). This includes the gross cash farm income (GCFI) with government payments subtracted out and presented separately (green and navy stacked bars, respectively). Cash expenses are also included (pink area). These figures are reported in billions of dollars. To provide further context, Figure 3 also includes the actual and projected (national average) crop revenues for the major program crops with the projections from CBO’s May 2023 baseline. The revenues are reported on a dollar-per-acre basis.

For these program crops, revenues have been significantly higher in recent years and are expected to remain high for 2023. Higher crop prices are driving up revenues per acre, which contributes to the high gross cash farm income levels while also reducing government payments. CBO’s projections into the future are for lower levels of crop revenues as prices adjust. Also notable in Figure 3 are the elevated cash expenses levels for 2022 and 2023. These figures present context for concerns that expenses will not decrease as quickly or as much as revenues and incomes. This is a significant driver of the expectations challenge for a farm bill because many farm interests want federal payments to increase in an attempt to at least partially offset the expected price or revenue and income declines.

The challenges presented by relatively higher crop prices are not unusual for farm bill reauthorizations, most notably in the efforts for the 1973, 1996, and 2014 Farm Bills. For 2023’s debate, however, the challenges are magnified by elevated expectations created by payment experiences since 2018. As indicated in Figure 2, farmers have received record levels of payments in recent years particularly from ad hoc and supplemental assistance programs not authorized in a farm bill. These ad hoc and supplemental payments have extended assistance to a much more extensive population of farmers than do traditional farm payment programs, including payments to livestock and specialty crop producers. Figure 4 provides an example, illustrating a categorical breakdown of the total payments from MFP 2019, CFAP 1 and CFAP 2 as reported by USDA (USDA, farmers.gov: MFP 2019; CFAP 1; CFAP 2). In total, these three programs have paid more than $45.7 billion to farmers.

Managing expectations in a farm bill debate could come from the payment experiences of livestock and specialty crop farmers who do not ordinarily receive direct payments in farm bill programs. An additional challenge from Figure 4 could be increased expectations for payments from those farmers who ordinarily receive farm program payments but have received much more in these ad hoc and supplemental programs. Figure 5 takes the MFP 2019, CFAP 1 and CFAP 2 payments for just the program crops and charts them by state. Figure 5 also adds the total ARC and PLC payments for 2018 to 2021 by state as reported by USDA-ERS (USDA-ERS, Farm Income and Wealth Statistics, Government Farm Program Payments). Farmers of these program crops received a total of $14.3 billion in 2018 through 2021 from ARC and PLC, with an additional $27.6 billion from MFP 2019, CFAP 1, and CFAP 2 payments. Farmers of these crops in Texas received the most in total, followed by those in Iowa, Illinois and Kansas.

Concluding Thoughts

Trying to reason with and manage expectations is a substantial challenge for any farm bill reauthorization. In 2023, that challenge could be greatly magnified if the ad hoc and supplemental payments in recent years have set expectations for payments at unreasonably and unachievably high levels; adding further complications, such expectations are coinciding with a time of high prices and incomes. Recall that in a farm bill reauthorization effort, the CBO baseline is controlling—it is the total amount of funding available to the committees and it is against the ten-year baseline that CBO scores any changes. The ad hoc and supplemental payments, however, are not included in the CBO baseline for a farm bill. Under budget rules, moreover, any increases in spending for a program or title is scored over 10 years, all of which must be offset by decreases from other programs or titles; in other words, a $1 billion change in program or policy could score $10 billion and require a large offset. This creates a zero-sum political dynamic that complicates the coalition building and maintenance necessary to pass a bill in Congress. For Title I farm program payments, any changes to increase payments would need to be offset by decreases within the title or from other titles in the bill. The politics for achieving offsets is exceedingly difficult and the search for offsets can make adversaries or enemies out of allies and coalition partners. The effort to reauthorize the Farm Bill in 2023 largely escaped unscathed from the debt limit negotiations, but the path ahead could become politically perilous in its own right with expectations out of alignment with budget and political realities.

Source : illinois.edu