Our results indicate that although consumers were frustrated by high food prices, most felt grocery store prices were fair. This was especially true of prices at dollar stores (e.g., Dollar General) and discount grocery stores (e.g., Aldi) – and about a third indicated they were going to these types of stores more often than before. The same was not true at restaurants, where about half of consumers felt prices were unfair. This was especially true for fast food restaurants, with about half saying they had reduced their frequency of visits due to prices. Finally, we find that consumers were most accepting of price increases if the reason was to accommodate increased ingredient costs or increased employee wages but were generally not accepting of increases to support improved profitability. Interestingly, about 15% of consumers thought there was no acceptable reason for price increases.

Methods

In this post we utilize results from the ninth wave of the Gardner Food and Agricultural Policy Survey (GFAPS), conducted online in May 2024. Each wave, GFAPS surveys approximately 1,000 U.S. consumers about their perceptions of food and agricultural issues and policies. A new panel of participants is recruited to participate in the survey in each wave, and participants are recruited to match the U.S. population in terms of gender, age, household income, and geographic region.

Results

Consumer Perceptions of Price Fairness

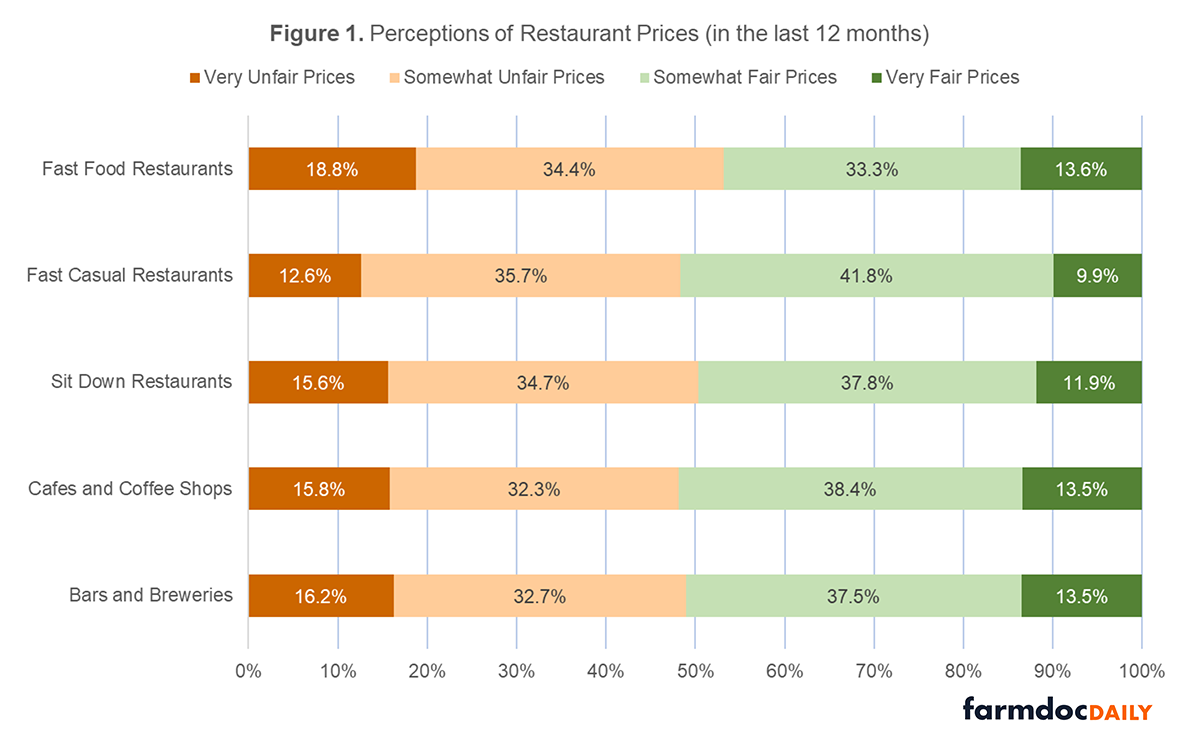

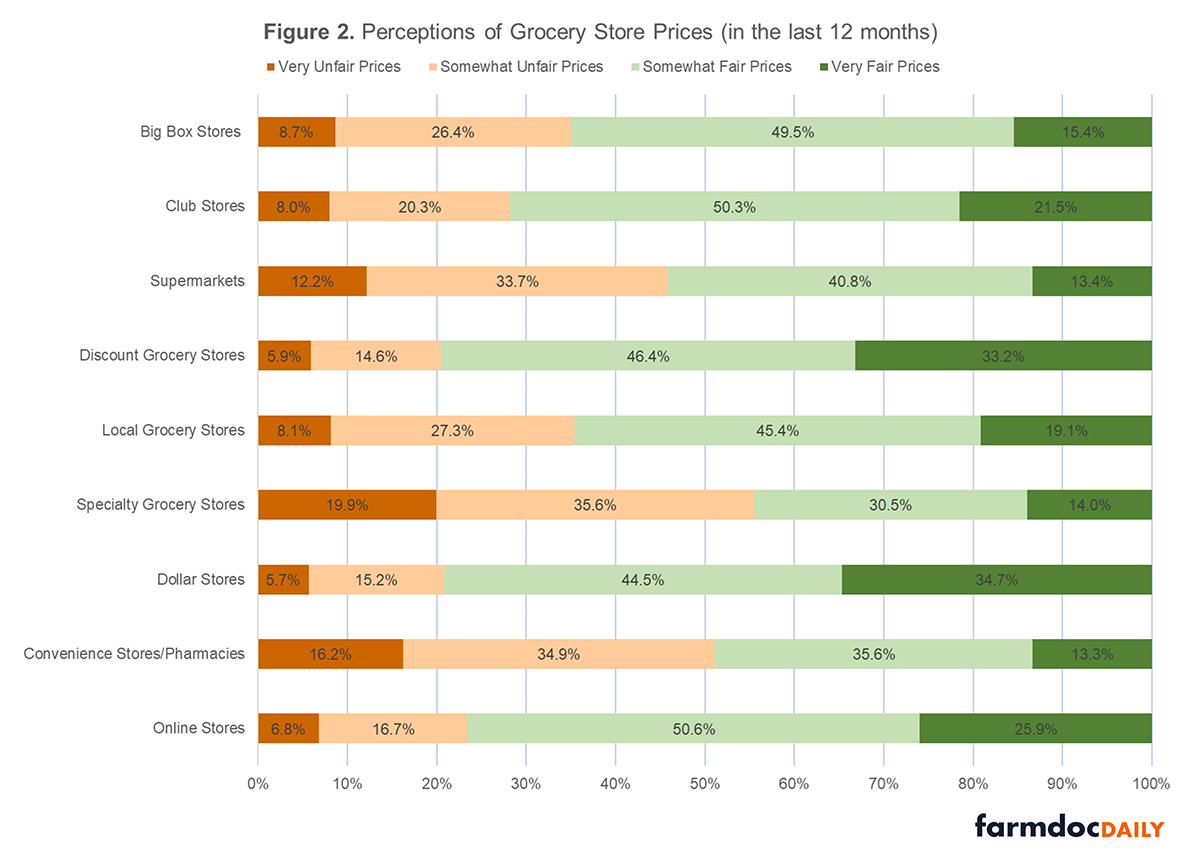

To assess perceptions of fairness, we asked participants to consider pricing at restaurant and grocery store types over the last year (12 months). Participants were able to indicate that they thought prices were very fair, somewhat fair, somewhat unfair, or very unfair. Participants were asked about five restaurant types – fast food restaurants, fast casual restaurants, sit down restaurants, cafes/coffee shops, and bars/breweries – and nine grocery store types – big box stores, club stores, supermarkets, discount grocery stores, local grocery stores, dollar stores, convenience stores/pharmacies, and online stores.1

For restaurants, we find that consumers were generally split on whether prices felt fair. About half of each restaurant type’s goers thought the prices were either very or somewhat unfair and about half thought prices were either very or somewhat fair (see Figure 1).

Consumers seem most frustrated by pricing at fast food restaurants, where 53.1% thought prices were unfair – more than any other restaurant type. Fast food restaurants were also more likely to be thought of as having very unfair prices (18.8%) compared to other restaurant types, which ranged from 12.6% (fast casual) to 16.2% (bars and breweries).

While consumers were split in their perceptions of restaurant pricing, most consumers felt grocery store pricing was at least somewhat fair (see Figure 2). Consumers were especially positive about grocery store types that tend to focus on keeping prices down – including discount grocery stores (e.g., Aldi, Lidl, Ruler Foods), dollar stores (e.g., Dollar General, Family Dollar, Dollar Tree), online stores (e.g., Amazon), and club stores (e.g., Costco, Sam’s Club, BJ’s). Here, more than 70% indicated they felt prices were either very or somewhat fair. Some of the most common shopping outlets (e.g., supermarkets) were not viewed as favorably.

Acceptable Price Increases?

To assess public perceptions of different reasons for price increases, we asked participants what (if any) reasons for increased food prices they found acceptable. The question was asked for both restaurants and grocery stores separately. Options included higher cost of ingredients, higher cost of energy or transportation, higher cost of employee wages, higher profitability, other, and none. Participants were able to select as many choices as they found acceptable.

We find that for both restaurants and grocery stores, the majority of consumers felt price increases to cover higher costs of ingredients or higher costs of employee wages were acceptable. Consumers were more accepting of price increases to cover ingredient costs at restaurants than grocery stores and more accepting of price increases to cover costs of energy or transportation for grocery stores than they were for restaurants. Far fewer consumers felt increased prices to cover higher profitability was acceptable (17.8% for restaurants and 17.2% for grocery stores). Interestingly, there were some consumers who thought there was no acceptable reason for price increases at either restaurants (15.2%) or grocery stores (14.3%).

Table 1. Percent of participants who indicated each reason for price increases was acceptable

Responses to Price Increases

To assess whether consumers responded to food prices by going to different types of restaurants or grocery stores with different frequency, we asked whether they had gone more or less often to each type the last year (12 months) due to rising food prices. Participants were asked not to include any changes in frequency for other reasons (e.g., a diet).

We find that about half of consumers indicated they were going less often to each restaurant type due to rising food prices (see Table 2). This ranged from fast food restaurants, where 51.6% said they were going less often, to cafes and coffee shops, where 45.8% said they were going less often.

Table 2. How participants say their frequency in restaurant visits has been affected by food prices

Note: Participants (N=1,014) were able to select N/A for any restaurant type they never utilize. Change in frequency of going to each restaurant category is based only on users.

For grocery stores, we find that over a third of consumers indicated they were going to discount grocery stores and dollar stores more often than usual and over 40% said they were going to specialty grocers (e.g., Whole Foods, Sprouts) less often than usual due to rising food prices (see Table 3).

Table 3. How participants say their frequency in grocery store visits has been affected by food prices

Conclusions

Although measures of inflation have cooled, food prices are still high, and consumers continue to be frustrated (farmdoc daily, June 10, 2024). In this post, we explore to what extent consumers’ feel food prices at restaurants and grocery stores are fair and what reasons for price increases they find acceptable.

Using results from the Gardner Food and Agricultural Policy Survey, we find that, although frustrated by high prices, most consumers felt prices were at least somewhat ‘fair’ at grocery stores. This was especially true of dollar stores and discount grocery stores, where over a third of participants indicated they were going more often due to price increases. Some of the most common shopping outlets (e.g., supermarkets) were not viewed as favorably.

Consumers were generally less impressed with pricing at restaurants, in particular, fast food restaurants. The majority of consumers felt fast food restaurant prices were unfair, and over half said prices were causing them to reduce their frequency of trips to fast food restaurants. These results are in line with other surveys that have found consumers say that they are eating out less and now think of fast food as a luxury (Shulz, 2024).

Finally, as price increases can occur for a variety of reasons, we asked explored what reasons for price hikes at restaurants and grocery stores consumers would find acceptable. Consumers were most accepting of price increases to accommodate increased ingredient costs and increased employee wages. Consumers were generally not accepting of increases to support improved profitability, and about 15% of consumers thought there was no acceptable reason for price increases.

Footnotes

1: Participants were given definitions for all restaurant and grocery store types before seeing questions. Specifically, restaurant type definitions were as follows:

- Fast Food Restaurants – Food is prepared very quickly, and they often include a drive-through option. National examples include McDonald’s, Wendy’s, Burger King, Sonic, Arby’s, etc.

- Fast Casual Restaurants – Food prepared quickly at the time of ordering. Does not offer full table service (i.e., waiters do not bring you your food). National examples include Panera, Chipotle Mexican Grill, Five Guys, Noodles and Company, etc.

- Sit Down Restaurants – These restaurants offer full table service (i.e., waiters will bring your food). These can have fancy or casual environments and food. National examples include: Applebee’s, Buffalo Wild Wings, Chili’s, Denny’s, Olive Garden, Red Lobster, TGI Fridays, etc.

- Cafes and Coffee Shops – Mainly focuses on the sale of coffee but often sells other items as well (e.g., tea, bakery items, sandwiches).

- Bars and Breweries – Mainly focuses on the sale of alcoholic beverages but often sells other items as well (e.g., appetizers, sandwiches).

For grocery store types, the definitions given to participants were as follows:

- Big Box Stores: Sells lots of items, including a large variety of food and non-food products. Ex: Walmart, Target

- Club Stores: Sells lots of items, including some food products. This is typically in a warehouse setting and consumers are usually charged annual membership fees. Ex: Costco, Sam’s Club, BJ’s

- Supermarkets: Sells a large variety of food products. Ex: Kroger, Albertsons, HyVee, H.E.B., Food Lion, Publix

- Discount Grocery Stores: Often sells a smaller selection of food products. Focuses primarily on private-label food products. Ex: Aldi, Lidl, Ruler Foods

- Local Grocery Stores: Sells a variety of food products in very few locations.

- Specialty Grocery Stores: Sells a variety of food products, but focuses on a particular kind of food, for example, organic food or ethnic food. Ex: Whole Foods, Sprouts

- Dollar Stores: Smaller store format with food and non-food items, often limited selection of food. Ex: Dollar General, Family Dollar, Dollar Tree

- Convenience Stores/Pharmacies: Smaller store format with food and non-food items, primarily focuses on convenience or pharmacy items. Ex: Walgreens, CVS, RiteAid

- Online Stores: Sells some food products, primarily online. Ex: Amazon

Throughout the definitions, mention of pricing strategies was not discussed to avoid biasing participants’ perceptions. Additionally, the order of the restaurant and grocery store question blocks were randomized to prevent ordering effects. For both measures of fairness and change in frequency, participants were also able to select N/A if they never utilized a particular restaurant or grocery store type. Non-users were not included in the analysis.

Source : illinois.edu