Calf prices make their lows in fall / early winter for several reasons. First, calf runs pick up as most spring calvers are selling weaned calves during this time. The timing on this is often weather driven, but usually happens in October / November. Secondly, changing weather patterns can create health challenges for calves, which tends to lower their market value. Based on local conversations, I do think this is an issue this year as well. Third, calf values become more impacted by feed-based programs once we move past the traditional grazing season. While wheat grazing operations are active placing calves in the fall / winter and some operations may have stockpiled pasture to start calves on, a large number of calves that move through markets in the fall are placed directly on feed. While this is very common, significantly higher feed prices this year are leading to a stronger preference for heavier feeders.

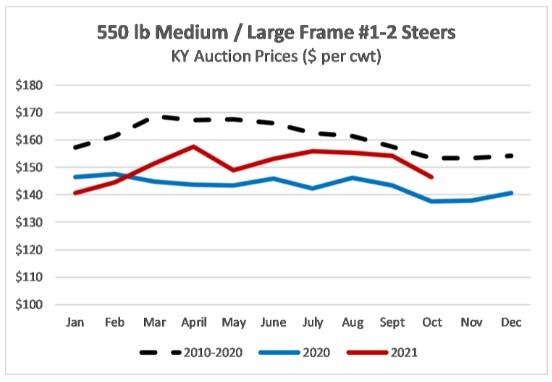

While declining calf prices in the fall is very typical, I do want to point out something unique about market conditions right now. Calves that move through markets in the fall, and go into growing operations, are driven by the cost of growing those calves through winter and their expected value in the spring. There is no question that the cost of growing calves on purchased feeds will be higher this winter, but the expected value of heavy feeders is also expected to be very strong come spring. As I write this on October 18, 2021, spring CME© feeder cattle futures are trading in the low $160’s. Basis can be very different across the south, but I would encourage everyone to consider what a spring CME© futures price in the $160’s suggests about the likely price of an 800 lb steer in their region for spring 2022. A quick glance at the chart below reveals that 550 lb steer calves have dropped below $150 per cwt in several southeastern states over the last few weeks. Using typical spring basis expectations, the market is currently suggesting that 800 lb steers in the spring may sell at a very similar price per cwt to a weaned steer this fall. This suggests very high value of gain on lbs that are added to calves this winter.

From my perspective, this has implications for cow-calf operators and winter backgrounders. First, if cow-calf operators have the ability to wean calves on the farm and retain ownership of them for a period of time, this may be a good year to consider doing that. A lot of the southeast has been blessed with adequate rainfall and many areas have stockpiled forage available to add some inexpensive post-weaning gains to calves. However, there is potential that feeding programs may also look attractive this winter due to expected higher value of gain. Operators want to avoid feed price “sticker shock” and not make their decisions based on feed prices alone. While feed prices are high, and winter cost of gain will be higher than we have seen for a long time, this must be compared to the expected value of gain on those lbs that could be added. This can only be done by running a detailed budget. Markets generally evolve with changes in cost of gain and we are seeing that occur this year. Spring CME© feeder cattle futures are suggesting a strong spring feeder market, and I think potential exists for good returns to growing programs this winter, despite current feed prices.

Source : osu.edu