By Leonard Polzi

The Dairy Margin Coverage (DMC) program continues to serve as a critical risk management tool for dairy producers, helping mitigate the impact of volatile milk and feed prices. The 2025 DMC program remains largely unchanged from previous years, with eligibility criteria and coverage levels maintained under the American Relief Act of 2025, which extended provisions from the 2018 Farm Bill and amended Section 1403 of the 2014 Farm Bill.

This article provides an update on key provisions, eligibility requirements, risk management considerations, and historical performance insights for the DMC program.

Key Provisions for 2025

Program Authorization: The DMC program has been reauthorized under the American Relief Act of 2025, extending previous Farm Bill provisions.

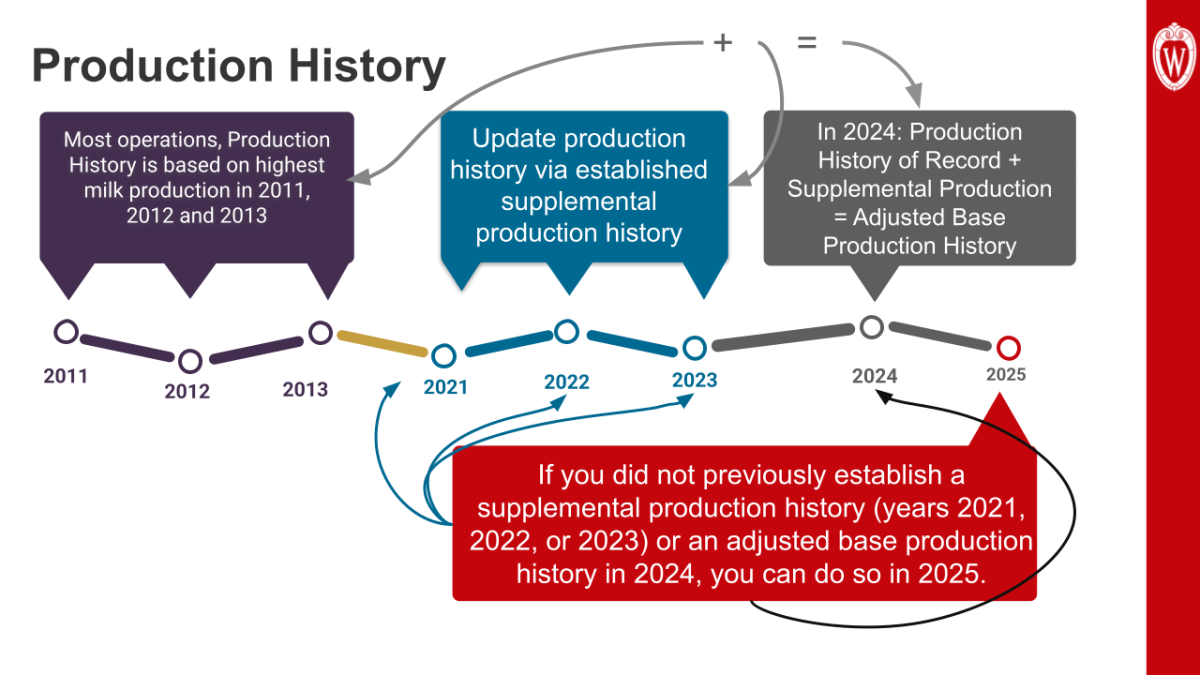

Annual Historic Production (AHP): 2025 DMC coverage is based on the highest milk production in 2011, 2012, and 2013 plus any supplemental production history established in 2021, 2022 or 2023.

Supplemental Production History: In 2025, eligible operations that did not previously establish supplemental production history may do so.

Enrollment Period: January 29 – March 31, 2025.

Risk Management Options for Dairy Producers

Producers assessing their dairy risk management strategies can choose from a range of approaches, starting with self-insurance, which involves opting out of formal coverage and thus remaining fully exposed to market fluctuations. Such an approach may be suitable for operations with strong balance sheets, sufficient cash reserves, limited market exposure, and/or diverse income streams, particularly if current market conditions and potential changes are viewed as internally manageable.

Futures and options function as hedging tools to lock in future prices, though utilizing derivatives carries inherent advantages and disadvantages, including transactional costs, margin calls, basis risk and knowledge/comfort level of these potentially complex tools. Cash contracts enable set price agreements with cooperatives or processors, providing some certainty in volatile markets.

Dairy Revenue Protection (DRP) offers market-based insurance covering quarterly revenue, while Livestock Gross Margin for Dairy (LGM-Dairy) addresses margin risk. Meanwhile, Dairy Margin Coverage (DMC) protects margins by triggering payments based on the difference between All Milk Price and feed cost at selected coverage levels.

When determining which strategy to adopt, producers should first clarify which specific risk income, expense, margin, or price volatility is being managed and assess how best to measure and mitigate it, whether it arises from production, price, or financial factors. Moreover, they should understand how multiple tools can interact, as DMC may be combined with DRP or LGM-Dairy to form a more comprehensive risk management framework.

Dairy Margin Coverage Program Mechanics

The DMC margin is calculated as the difference between the National All-Milk Price and a calculated feed cost to produce 100 lbs of milk, consisting of corn, soybean meal, and premium alfalfa hay prices. This approach attempts to reflect changes in broad market conditions impacting profitability at the farm level. DMC coverage has two tiers:

Tier 1: Covers the first 5 million pounds of production with margin coverage from $4.00 to $9.50/cwt at lower premium rates as compared to Tier 2 premiums.

Tier 2: Covers production above 5 million pounds, with a maximum coverage level of $8.00/cwt and higher premiums.

Premium costs vary by coverage level in both tiers. Table 1 outlines the tier structure and premium rates.

.png)

Supplemental DMC Eligibility and Adjusted Base Production History

For most operations, production history is based on the highest milk production in 2011, 2012, and 2013. New dairy operations may establish a production history from recent annual production levels. During the years of 2021, 2022, and 2023 dairy operations that increased milk production levels over their established production history were able to update production history through an established supplemental production history. For 2024 DMC, participating dairy operations production history of record were combined as adjusted base production history. Eligible DMC dairy operations that did not previously establish a supplemental production history or an adjusted base production history in 2024, may do so in 2025 (USDA, FSA, 2025).

In 2024, FSA revised DMC regulations to allow eligible dairy operations a one-time adjustment to their established production history. The adjusted base production history uses actual 2019 marketings and follows the same calculation method used for supplemental production history. To qualify, operations must have an established production history under five million pounds, submit Form CCC-800B (Adjusted Base Production History Establishment) during the 2024 registration and coverage election period, provide documentation of 2019 marketings, and not have established supplemental production history between 2021 and 2023. Separately, operations that established supplemental production history from 2021 to 2023 must combine it with their existing production history to form a single adjusted base, which becomes the production history of record for the 2024 and 2025 DMC contracts.

Figure 1 below visually depicts the progression of changes in production history determinations to help identify if an operation is eligible for supplemental production history in their 2025 enrollment.

Historic Performance and Forecast for 2025

From 2018 to 2024, DMC issued payments in 48 out of 72 months (66.67% of the time). Over this period, the average payment per cwt was $1.49 per hundredweight (cwt), with a maximum payment of $5.58/cwt. After accounting for the average premium cost of $0.142/cwt, the net indemnity averaged $1.35/cwt. These historical data points underscore the program’s relevance in mitigating downside risk for participating dairy producers.

Considering what market factors influence the DMC program calculations the most, we find that changes in the All Milk Price and corn price have the largest impacts on margin. Table 2 shows how changes in program market prices impact DMC margins. The all-milk price has a direct 1:1 relationship with the margin, while corn price increases have the most significant negative effect. Corn price volatility remains the biggest feed price risk in program pricing, with a $1 increase reducing the margin by $1.07. Soybean meal and alfalfa hay prices have comparatively smaller negative impacts.

.png)

Although forecasts suggest minimal or no DMC payments in 2025 and limited payouts in 2024, dairy producers should carefully consider the program’s proven track record. Over the life of the program payments have been in 66.67% of months, providing an average net indemnity of $1.35/cwt (accounting for premium cost) evidence of its effectiveness in mitigating market volatility. With the potential for All Milk Price reductions of $0.10–3.00/cwt due to policy shifts and FMMO reforms, alongside rising Class III utilization in the second half of 2025, remaining enrolled in DMC can serve as a prudent safeguard within a broader risk management strategy. Additionally, producers who are eligible to update or establish supplemental production history have an opportunity to enhance coverage levels. Overall, the 2025 DMC program continues to offer a critical buffer against pricing uncertainties, building on the strong historical performance of timely payouts and reinforcing the value of thoughtful, proactive enrollment decisions.

Source : wisc.edu