By Don Shurley

The destruction of markets and prices due to the impacts of the coronavirus are unprecedented. In 40 years as an economist and analyst—30 years of that in cotton, I’ve not seen anything like this.

About a year ago, the price of cotton was over 75 cents. For “non-corona” reasons, price then declined over 20% by early September. Prices began to improve during the harvest period, and by around the first of the year, were back up over 70 cents—gaining back to 93% of the previous high. Over the past 4 to 6 weeks, price has declined almost 30% due mostly to “coronavirus impacts”. May 20 futures dipped below 50 cents this week.

I have received numerous calls and emails recently from growers still holding significant portions of last year’s crop. It is very unusual to see this magnitude and proportional decline in price post-harvest. It’s not unusual for price to decrease rather than increase while storing the crop—but this magnitude of a drop, and here we are soon to plant another crop—the options are limited and none of them win a beauty contest.

I was asked recently how much lower can we go. Prices are now the lowest they have been since the 2008 crop marketing year, when prices were in the low 40’s. We all hope and pray we don’t see that again—but, that’s the short answer.

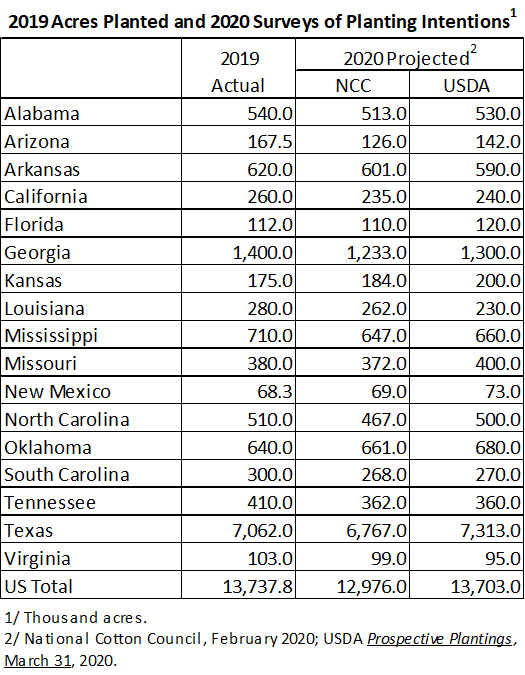

Prices are impacted by US and global economic fears due to the coronavirus pandemic, the resultant fear of weak demand, and now this week’s bearish USDA Prospective Plantings report. The USDA report says that growers intend to plant 13.7 million acres of cotton this year—essentially no reduction from last season’s 13.74 million acres. Most observers/analysts were expecting a 5 to 10% reduction in acres due to low prices. The National Cotton Survey back in early February projected a drop in acres of 5½ %.

The USDA numbers in comparison to the NCC are close, and the differences insignificant with one exception—Texas. USDA projects 546,000 acres more in Texas than the NCC survey. So, as always, Texas is the wild card. The first USDA estimate of actual acres planted will be out on June 30. Unless price improves and approaches 68 cents or better (and it’s not likely that will happen for a while), or unless growers have confidence that the market will eventually get there, I expect actual acres planted to be close to the NCC number or less.

This week’s export numbers were good. The market has mostly shrugged off the good numbers in recent weeks, but prices did improve today. All eyes will be on the World Use numbers in USDA’s April supply/demand estimates.