By Don Shurley

My kids, and now grandkids, seem to enjoy the cheap, unexpected surprises in their Christmas stocking as much as anything. USDA’s December crop production and supply/demand estimates were as expected, in some respects, but contain a few things that maybe can be viewed as unexpected and positive.

Prices (March futures) continue to track in a range of mostly 70 to 72 ½ cents, but I sense cautiousness in the market. Today’s close at 70.8 cents is the lowest since mid-November.

The US crop is now projected at 16.52 million bales—up 360,000 bales from the November estimate. This is due largely to a nearly ½ million bale increase in the Texas crop, but offset somewhat by an additional 150,000 bale reduction in the Carolinas and Virginia crops.

Compared to the November estimates, yield and production were increased in 7 states, and reduced in 4 states. The Georgia crop was unchanged at 915 lbs per acre and total production of 2.25 million bales. Production loss in the Carolinas and Virginia is estimated at almost ¼ million bales.

The eventual US crop is still uncertain. The last USDA report showed the Texas crop as 71% harvested as of Nov 27th. Further news has been that cold weather and continued harvest progress have been concerns since then.

US exports for the 2016 crop year were raised 200,000 bales to 12.2 million bales. I am wary of this increase, as this will require us to pick up the amount and pace of exports in a market that seems to slow down when cotton is above 70 cents. Also, Australia is expected to increase production and exports.

World production was raised almost 1 million bales compared to the November estimate—due mainly to higher estimates for the US and Australia. India, Pakistan, and China are unchanged.

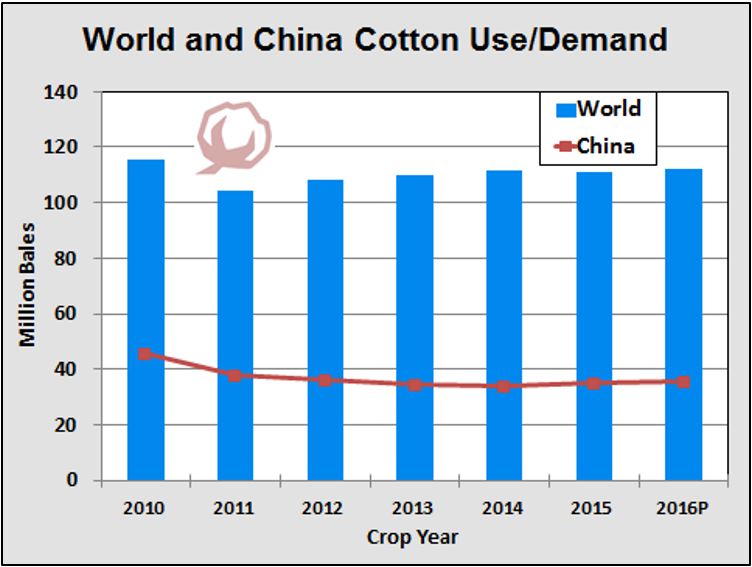

World Use/demand is projected at 111.91 million bales—down slightly from the November estimate. While the reduction is ever so slight, this marks the second consecutive month that Use has been adjusted down (Use was projected at 112 million bales in October). If realized, this would still be .6% above last season, but not the more robust kind of growth cotton needs to see.

On a positive note, mill use in China was increased ¼ million bales to 35.75 mb. If realized, this would be the highest since 2012—still not the China we would like to see, but any increase is good, if it eventually leads to more US exports. We need to keep an eye on US-China political tensions and any trade implications.

India Use was reduced ¼ million bales, but Vietnam imports and Use were both increased 200,000 bales.

Factors, some of them discussed here, are out there that could push prices back to 72-73 cents, but I don’t know that I would risk more than 20 to 25%, maybe one-third at the most, of my crop on that possibility. Basis and fiber quality premiums in the Southeast continue strong and offer good cash market opportunity even with futures prices at current levels.

Source:ufl.edu