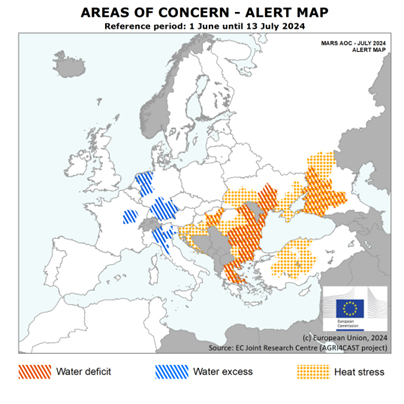

The August 2024 World Agricultural Supply and Demand Estimates (WASDE) decreased EU production by 2.0 MMT to 128.0 MMT, 5% below last year and the five-year average. According to FranceAgriMer, the French wheat crop sits at 26.3 MMT, down 24% from the five-year average and the lowest output in nearly 40 years. Looking at quality, early testing shows a lower test weight of 74-75 kg/hl while protein sits around 11% (dry matter basis). Stratégie Grains has assessed that just 72% of the harvest meets milling quality standards, a decrease from last year’s 84%.

In Germany, conditions were more favorable, but damp weather still affected planting and crop development. As a result, the Stratégie Grains estimates for German production sit at 19.2 MMT, down from 21.3 MMT last year. Similarly, Stratégie Grains expects a 9.4% decrease in Polish wheat production due to dry conditions in May and June. Of the major EU exporters, only Romanian wheat production holds strong at 10.3 MMT, according to Stratégie Grains. With decreased production in several key producers, USDA estimates put EU exports down 9% to 34.0 MMT.

Dryness in the Black Sea

The August WASDE kept the much-anticipated Russian wheat crop at 83.0 MMT, down 8.4 MMT from last year, weighed by the well documented influences of drought on yield potential. Likewise, SovEcon lowered their Russian wheat production estimates by 1.8 MMT to 82.9 MMT, in line with the USDA. Likewise, USDA put Ukrainian production at 21.6 MMT, a 1.4 MMT reduction from 2023/24 due to dry conditions.

Supply and Demand Impacts

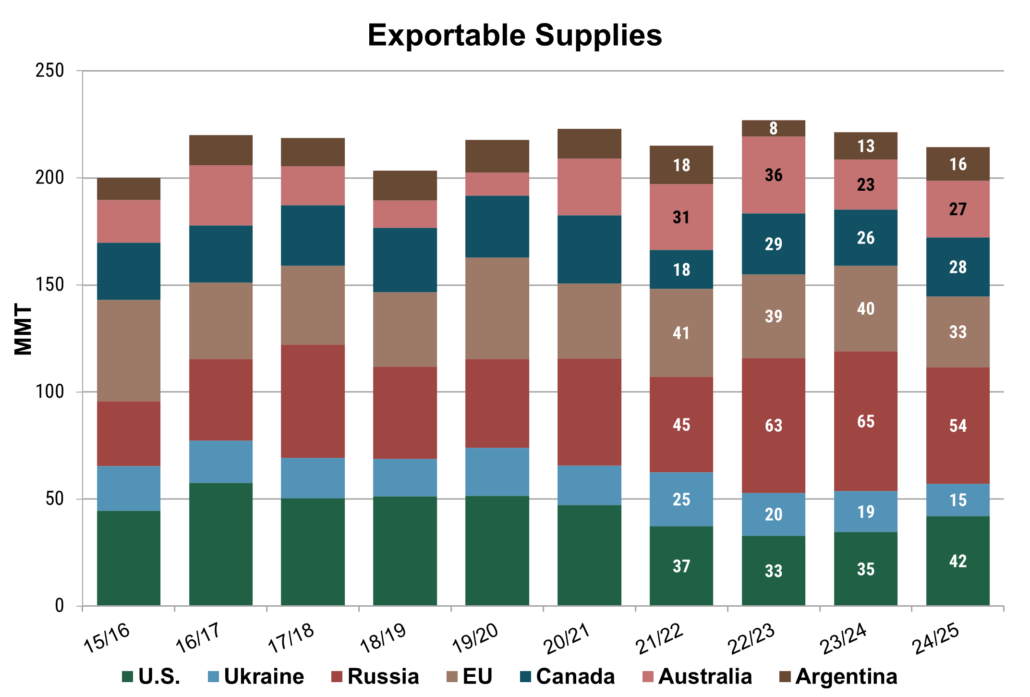

Despite a cumulative 16.7 MMT drop in wheat production from the EU, Russia, and Ukraine, the total output for major exporters is just 1% lower than last year (2.9 MMT) and 1% below the five-year average. Increased production forecasts from the U.S., Australia, and Canada have balanced out the declines, contributing to adequate global wheat availability. Nevertheless, the decreased EU and Black Sea production will more heavily impact importers in the MENA region such as Morocco and Egypt, which may prompt them to buy from alternative suppliers.

Click here to see more...