By Michael Langemeier

Center for Commercial Agriculture

Purdue University

COVID-19 and fluctuating fed cattle and feed prices resulted in another challenging year for cattle finishers. An earlier article (farmdoc daily

October 9, 2020) examined net returns for the first nine months of 2020. This article updates feeding cost of gain, breakeven prices, and net return estimates for 2020 and provides projections for the first half of 2021. It is important to note that the net return estimates in this article do not include Coronavirus Food Assistance Program (CFAP) payments. Information pertaining to these payments can be found in the fact sheets listed in the citations.

Several data sources were used to compute net returns. Average daily gain, feed conversion, days on feed, in weight, out weight, and feeding cost of gain were obtained from monthly issues of the Focus on Feedlots newsletter (

here). Futures prices for corn and seasonal feed conversion rates were used to project feeding cost of gain for the next several months. Net returns were computed using feeding cost of gain from monthly issues of the Focus on Feedlots newsletter, fed cattle prices and feeder cattle prices reported by the Livestock Marketing Information Center (LMIC) (

here), and interest rates from the Federal Reserve Bank of Kansas City.

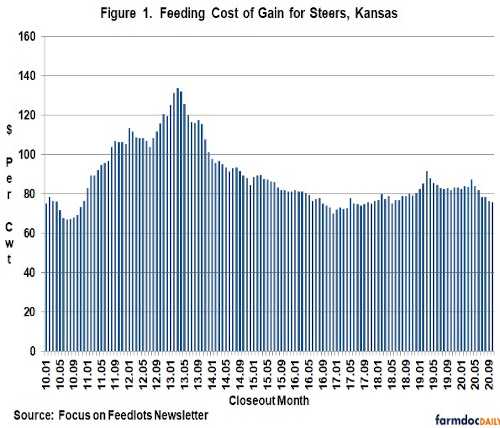

Feeding Cost of Gain

Figure 1 illustrates monthly feeding cost of gain from January 2010 to October 2020. Feeding cost of gain averaged $84.37 per cwt. in 2019 ranging from a low of $81.61 in October to $91.67 in March. Feeding cost of gain per cwt. averaged $83.27 in the first quarter and $84.28 in the second quarter of 2020. Feeding cost of gain for the third quarter averaged $77.75 per cwt. Average feeding cost of gain for the fourth quarter of 2020 is projected to be similar to that experienced in the third quarter. Due to large increases in corn prices in recent months, projected feeding cost of gain for the first quarter of 2021 is expected to range from $83 to $87 per cwt. with the largest feeding cost of gain occurring in March. For the second quarter of 2021, projected feeding cost of gain is expected to range from $82 to $86 per cwt. with the largest feeding cost of gain occurring in April. The lower feeding cost of gain for May and June is not due to lower corn price projections. Rather, feed conversion is typically lower during these two months than feed conversions from January through April.

Feeding cost of gain is sensitive to changes in feed conversions, corn prices, and alfalfa prices. Regression analysis was used to examine the relationship between feeding cost of gain, and feed conversion, corn prices, and alfalfa prices. Results are as follows: each 0.10 increase in feed conversion increases feeding cost of gain by $1.24 per cwt., each $0.10 per bushel increase in corn prices increases feeding cost of gain by $0.88 per cwt., and each $5 per ton increase in alfalfa prices increases feeding cost of gain by $0.50 per cwt.

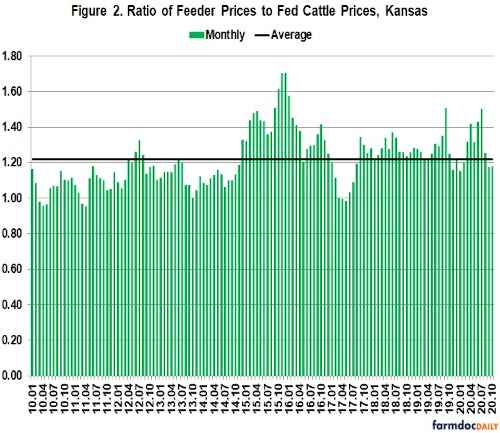

Feeder to Fed Cattle Price Ratio

The ratio of feeder to fed cattle prices since January 2010 is illustrated in Figure 2. Since January 2010, this ratio averaged 1.22. The feeder to fed price ratio was one standard deviation below (above) this average for 17 (19) months since January 2010. The average net return for the months in which the ratio was below one standard deviation of the average was $143 per head. In contrast, the average loss for the months in which the ratio was above one standard deviation was $257 per head. The average ratio for the 19 months with a feeder to fed price ratio that was above one standard deviation of the long-run average was 1.49. The feeder to fed cattle ratio averaged 1.22, 1.39, and 1.31 in the first, second, and third quarters of 2020, respectively. In October and November, the feeder to fed cattle ratios were 1.18 and 1.20. The ratio is projected to average 1.25 in the first quarter and 1.20 in the second quarter of 2021.

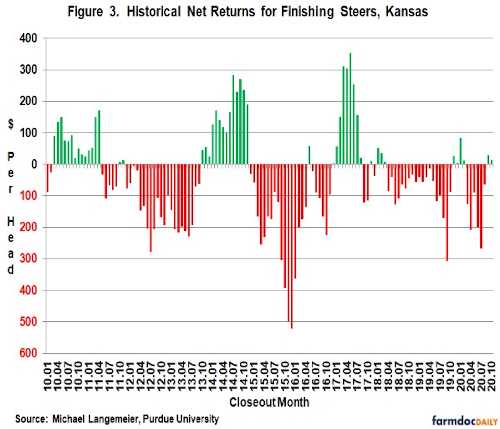

Net Return Prospects

Monthly steer finishing net returns from January 2010 to October 2020 are presented in Figure 3. It is important to note that net returns were computed using closeout months rather than placement months. Net losses in the first quarter and second quarter of this year averaged $10 and $165, respectively. The large loss in the second quarter was primarily due to the relatively higher feeder to fed cattle ratio during this period. Losses in the third quarter averaged $100 per head and ranged from a loss of $265 in July to a net return of $30 in September. Estimated losses for the fourth quarter are estimated to be approximately $35 per head.

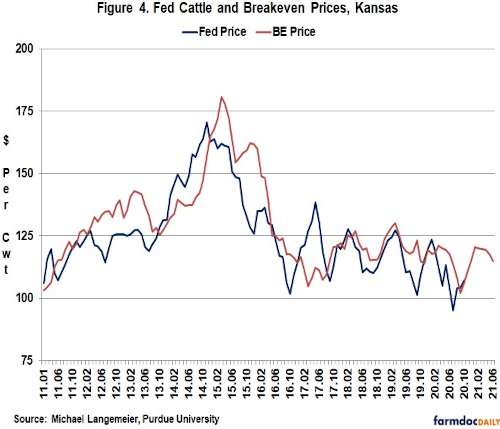

Historical and breakeven prices for the last ten years, as well as projected breakeven prices through the June of 2021, are illustrated in Figure 4. Breakeven prices for the first two quarters of this year averaged approximately $119 per cwt. Average breakeven prices for the third quarter and fourth quarter were approximately $108 and $111, respectively. For the first and second quarters of 2021, breakeven prices are expected to range from $117 to $120. Combining these breakeven prices with Livestock Marketing Information Center (LMIC) fed cattle price projections results in expected losses ranging from $75 to $100 in the first quarter, and net returns close to breakeven during the second quarter of 2021. Due to the amount uncertainty related to the current market environment, our typical caveats apply to these projections. Net return prospects could change rapidly.

Conclusions

This article discussed recent trends in feeding cost of gain, the feeder to fed price ratio, breakeven prices, and cattle finishing net returns. Average cattle finishing losses in 2019 were estimated to be approximately $80 per head. Average losses for 2020 are projected to be approximately $75 per head. Current breakeven and fed cattle price projections suggest that net returns will be similar to those in 2020 in the first quarter, and closer to breakeven levels in the second quarter of 2021.