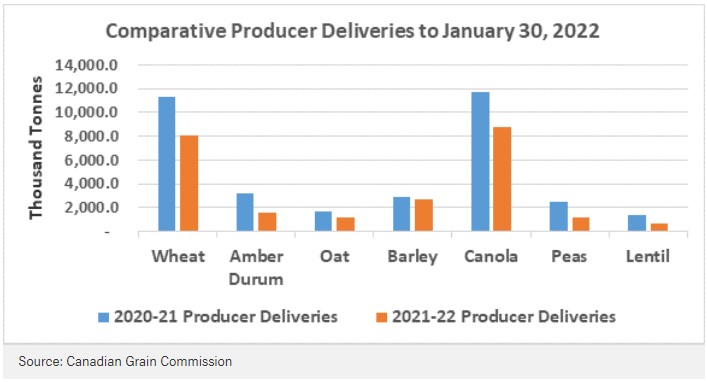

Figure 1. Comparative producer deliveries to January 30, 2022

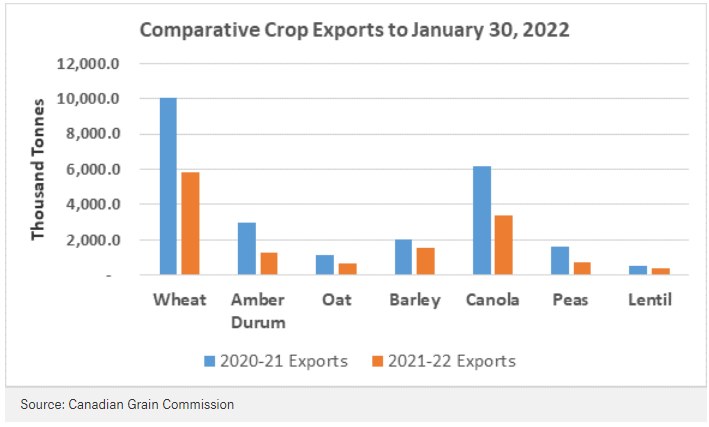

‘Exports of all major Western Canadian crops are lower as expected, following the lower crop production. A function of price is to meter demand to available supplies, and historically high prices have provided a restraint to Canadian crop exports. Barley exports have slowed after a much stronger start compared to the previous crop year, likely due to a heavy volume of forward contracting by barley importers for fall delivery.’

Figure 2. Comparative crop exports to January 30, 2022

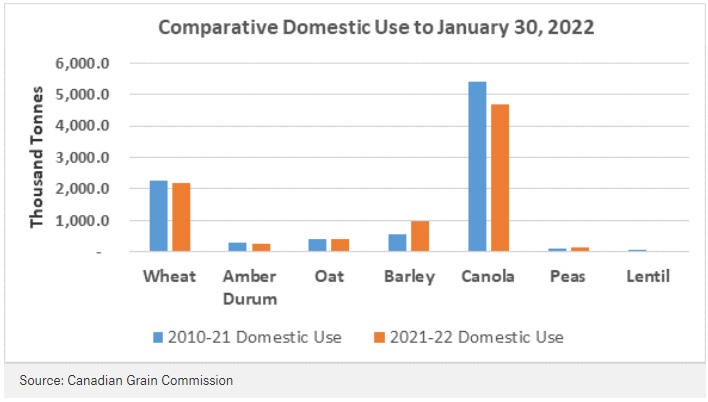

At this point, domestic use of crops is less affected by the reduced supplies than are export volumes. Crop buyers for domestic use have, for most of this crop year, outbid the export market to ensure that their needs are met, whether that be for milling, crushing, malting, fractionation, feeding or other uses.

Figure 3. Comparative domestic use to January 30, 2022

Note that a significant volume of feedgrain is excluded from these numbers since most of that bypasses the elevator system for direct sale to an end-user, or is used by the crop producer for on-farm feeding.

‘High crop prices tend to be more volatile and that has been the case so far this crop year. With most Canadian crop supplies in tight supply, as we move into the next growing season, the effects of price-moving factors of weather, currency changes and world political events will be magnified,’ says Blue.

Source : alberta.ca