While the 2023 crop is still expected to return to sub-$5 prices after two years of prices at or above $6 a bushel, the average farm price estimate was raised to $4.90 a bushel in the report, a 10 cent and 2.1% increase from the July WASDE projection. By close on August 11, December futures for corn had fallen to $4.74 a bushel.

Cotton

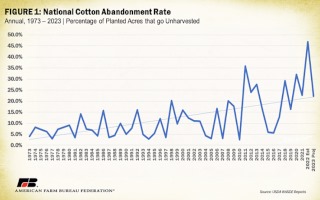

2023 cotton production projections dropped significantly from the July report, falling 15.2% to 13.99 million 480-pound bales. Year-over-year, this would indicate a reduction in production of 3.3% or 2.51 million bales. The 2023 production projection is far below industry expectations before the report release, which ranged from approximately 15.25 million to 16.25 million bales. The dramatic drop in production was caused by higher abandonment and lower yield estimates, with the national abandonment rate now projected at 22.2% and yields reduced to 779 pounds per acre. While still a high rate of abandonment, it is nowhere near the high rate of abandonment estimated in the 2022 crop, where 46.9% of planted cotton fields went unharvested.

Cotton abandonment rates have been rising, with a steady increasing trendline over the past 50 years and increasing year-on-year variability. The problem is particularly acute in Texas, the country’s largest cotton producer, which has had an average abandonment rate of 21% since 1980. An analysis from Texas Tech found that the biggest factor related to abandonment rates in Texas has been temperature, as measured by growing degree days, which have also been on an upward trend since 1980. As projected, 2023 will be the seventh straight year with national abandonment rates over 10%.

Revisions to other country’s cotton production did not make up for the drop in U.S. production, and total foreign ending stocks fell 2.22 million bales (2.4%) to 90.72 million bales.

Soybeans

Like corn, both soybean production and yields fell slightly below expectations and dipped from July’s report, falling 2% each to 4.205 billion bushels produced and yields of 50.9 bushels per acre. Despite an increase in projected beginning stocks (+2%, 260 million bushels) and imports (+50%, 30 million bushels), estimated supply is still expected to fall 2% to 4.496 billion bushels. While projected usage was also adjusted down, it fell only 1%, which led to projected ending stocks decreasing 18% to 245 million bushels.

Multiple states are projected to have a record soybean yield including Indiana (60 bushels per acre), Ohio (57 bushels per acre), Mississippi (56 bushels per acre), Arkansas (53 bushels per acre), North Carolina (40 bushels per acre) and South Carolina (40 bushels per acre). The largest projected percentage increase in yields is in Oklahoma, where they are projected 82.4% higher than last year’s at 31 bushels per acre. The largest decrease is projected in Wisconsin, which falls 7.4% year-over-year to 50 bushels per acre.

Like corn again, the new crop average farm price is significantly down year-over-year, falling 10.6% to $12.70 a bushel. However, with tightening projected supplies, the price rose 2% from the July WASDE report and is up nearly 5% since the 2023/24 marketing year crop was first projected in the May WASDE at $12.10.

Wheat

Wheat’s overall domestic production for the 2023/24 marketing year, beginning June 1, shifted minimally, down only 0.3% (5 million bushels) over the July WASDE report. However, the total wheat production number hides movement between winter and spring wheat. Hard red winter wheat is projected up 8 million bushels (+1.4%), hard red spring is down 28 million bushels (-6.3%), soft red winter is up 18 million bushels (+4.3%), white is down 6 million bushels (-2.4%), and durum wheat is up 3 million bushels (+5.6%).

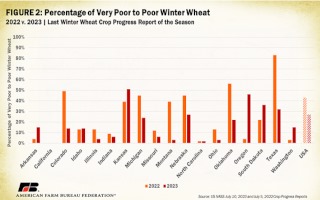

The 2023 winter wheat crop had the third-highest abandonment rate on record, and the highest since 1933, with 30.7% of planted acres abandoned. High rates of abandonment were due to extremely dry conditions in Kansas this spring and winter. While conditions recovered somewhat toward the end of the season, in the last winter wheat condition report of the season, published on July 10, 51% of Kansas winter wheat was rated very poor to poor.

As Kansas has the most winter wheat acres of any state at 8,100 planted in 2023 (22% of national total), it dominates the national wheat numbers. Many other states are having a better year than last year when six states had 30% or more of the winter wheat crop rated very poor to poor. In 2023, only four states reached a similar level.

Globally, the wheat supply projections were reduced by 4.3 million tons (0.4%), with falling production predominantly in the European Union, Canada and China partially offset by increases in estimated production in Ukraine and Kazakhstan. Despite the increase in Ukrainian production, its export levels were kept the same due to the ending of the Black Sea Grain Initiative. Notably, global 2023/34 projected ending stocks were reduced by 0.3% (0.9 million tons), which would be the lowest ending stocks since the 2015/16 marketing year.

Click here to see more...