“It has been a decade since March corn acres have come within less than 1% of the average trade guess, meaning the market frequently misses by more than a million acres,” Braun reported. “Bulls won’t like this nugget. Over the last two decades, March corn acres have never landed below the average trade guess when the new-crop Chicago soybean-corn futures ratio averaged 2.3 or below during February. This year notched a corn-favoring 2.24. Bearish March corn acres are also more common when estimates for the previous corn harvest shrank as they did this year.”

Some Analysts Expect Corn Acres Above 95 Million

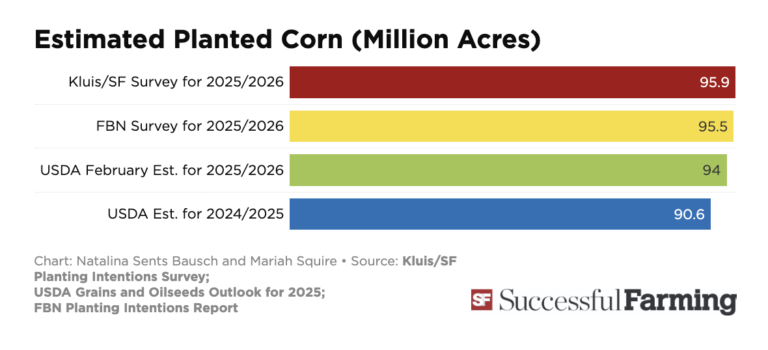

Successful Farming’s Natalina Sents Bausch reported that Farmers Business Network (FBN) “forecasted U.S. farmers will plant 95.5 million acres of corn in 2025. This is an increase of 4.9 million acres from last year. Acres will be shifting out of soybeans and wheat to grow more corn, the company said. The biggest increase in estimated corn acreage was seen in Iowa and Kansas.”

“FBN’s estimates were derived from a survey of almost 1,000 U.S. farmers that represent 2 million acres of total production,” Sents Bausch reported.

Successful Farming’s Cassidy Walter also reported that “according to the Kluis/Successful Farming survey, farmers anticipate planting 95.9 million corn acres for the 2025/2026 crop year, up from 90.6 million in 2024/2025. Al Kluis, managing director of Kluis Commodity Advisors, described the survey’s findings as negative for corn, bullish for soybeans, and neutral for wheat. He also noted this year’s survey received record participation.”

“For Monday, the Dow Jones pre-report survey of 18 analysts is calling for 94.2 million acres (ma) of corn to be planted this spring, up from 90.6 ma in 2024 and in line with the 94 ma unveiled in the Ag Outlook Forum last month,” Progressive Farmer’s Montgomery reported. “For soybeans, 83.8 ma are expected. Again, this is in line with the USDA Outlook’s early estimate.”

Market Volatility Likely After USDA Report on Monday

“Perhaps no USDA release garners more speculation than the annual Prospective Plantings report, and as a result, the day also carries an increased chance of volatile price action,” Montgomery reported. “Over the past five releases, nearby corn futures have averaged 12-cent moves higher the day of the release, including a 16-cent gain following last year’s bullish surprise, which estimated corn acres about 2 million acres lower than the average trade guess. For soybeans, the report has proven even more volatile, with a 72-cent gain following 2021’s report and a 50-cent drop following 2022’s report.”

Source : illinois.edu