Lamb and mutton imports for January to April 2021 are 7,411 tonnes, down 11.7% from 2020 and 1% below the 5-year average. In 2021, fresh/chilled lamb imports are 2,365 tonnes, an increase of 14.9% from 2020, while frozen imported lamb has declined 11.4% to 4,244 tonnes. Mutton imports are down 57.9% in 2021 at 933 tonnes. Imports of frozen lamb and mutton have declined significantly from Australia and New Zealand, due in part to expansion efforts.

In the first few months of 2021, Canadian federal and provincially inspected slaughter is down 3.5% year-over-year. In the west, slaughter is down 0.6% compared to year-over-year declines of 3.1% in Ontario and 6.8% in the Quebec/Atlantic region.

‘Demand for lamb products has experienced a shift over the last year. The loss of foodservice has been offset with increased consumer retail purchases, led in part by a willingness among home chefs and younger shoppers to spend more time cooking non-traditional proteins,’ says Wood.

Demand is also being driven by first-generation Canadians, who traditionally consume lamb as a staple protein. The combination of these factors has led to record prices for lamb, with wholesale lamb prices reported to be up more than 50% in some cases.

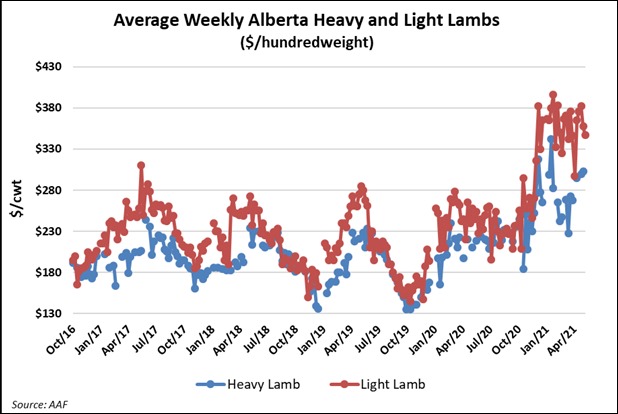

‘Alberta light and heavy auction lambs continue to move at prices will above average. Year-to-date, light and heavy auction lambs are trading 30% to 45% above 2020 and over 40% higher than the 3-year average.’

Seasonally, prices tend to peak in June then trend lower in the second half of the year. Last year, prices did not follow the historical seasonal pattern and were stable through most of the summer and fall followed by strong gains into yearend.

Image 2. Average weekly Alberta heavy and light lamb prices

Global demand for lamb remains strong and consumption is forecasted to increase an average of 1.7% to 1.9% per year over the next decade.

‘As we transition through the global economic recovery, strong demand mixed with tighter supplies of lamb and mutton is expected to be price supportive. Consumer preference for lamb has grown, but uncertainty remains around the future structure of demand and how the return of foodservice will affect current retail sales,’ says Wood.

Currently, Canada produces about 40% of annual lamb consumption, with the remainder being imported.

Source : alberta