African Swine Fever has been making headlines recently as the number of cases reported in China has been on an upswing in recent months. It should be mentioned that ASF never left China, and the country has been battling the virus over the past several years, with new outbreaks reported throughout the past year. However, the situation seemed to be improving for the country’s swine population; the Ministry of Agriculture

projected confidently in December that it largely had the virus under control and that its pig and sow herds would be fully recovered by the first half of 2021. The recent rise in reported cases of ASF in the country highlights already existing questions about this rosy picture, as well as the general uncertainty surrounding production in the country and its impacts on global flows of animal protein.

Increased ASF Outbreaks Raise Questions About Herd Recovery

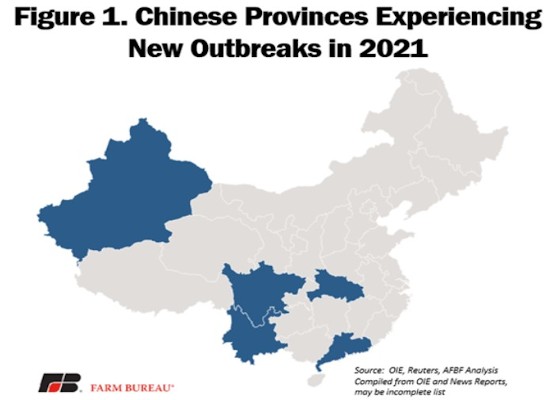

Reported outbreaks of ASF in China have risen over the past several months, with new outbreaks reportedly occurring in at least five separate provinces, as shown in Figure 1. Note: This list of outbreaks may be incomplete as it is compiled from both official reports to the World Organization for Animal Health (OIE) and various news reports. Contributing to the rise in outbreaks have been new mutant variants of the virus. Two specific strains that have recently been detected reportedly are less virulent than previous strains, which makes them more

difficult to detect and thus easier to spread between pigs because the disease goes undetected, making it even harder to control ASF. This is particularly bad for piglets born with weakened immune systems. The source of these mutations is still in question, but several

experts point to the use of unapproved and illegal vaccines in significant portions of the herd as a source.

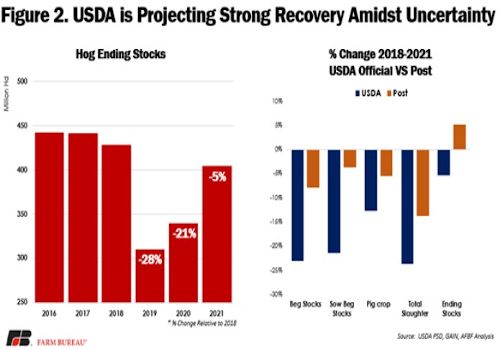

With so much uncertainty emerging, it is very difficult to know the full impact of the increase in outbreaks on current and future production. This is intensifying the already existing uncertainty around official recovery numbers. The current USDA forecast points to 2021 hog ending stocks finishing just 5% below pre-ASF levels of 2018, however these forecasts are slightly dated and likely do not reflect new information. USDA is slated to update their official forecasts in early April. This recovery in ending stocks is quite remarkable considering the nearly 30% decline in 2019 from 2018, and over 20% when comparing 2020 to 2018. Again highlighting the difficulty in knowing for sure what the true impact is, there are wide disparities between the official USDA forecasts and what USDA offices within country are saying.

USDA Post is reporting numbers much more closely aligned with official Chinese government numbers. When comparing the 2021 forecast with pre-ASF levels in 2018, the official USDA number for beginning stocks shows a 23% decline, while Post is reporting just an 8% decline. Total pig crop for the year is estimated to be down 21% by USDA but Post only shows a 5% decline. When looking at where 2021 ending stocks will fall, USDA is reporting a 5% decline from 2018, while Post is actually reporting a full recovery with ending stocks 5% above the end of 2018. The point in examining these differences is not to paint one side as right or wrong, but rather to highlight how difficult it is to know for sure where the recovery is.

While it is difficult to fully understand the impact the recent outbreaks have had on animal numbers, many in the industry are painting a more challenging picture ahead. One

analyst’s estimation that as many as 8 million sows have been culled in just the last six to eight weeks has received significant attention. If this estimate is true (this is a relatively aggressive assumption, but it’s impossible to know), that would amount to roughly a quarter of USDA’s official estimate of 2021 beginning sow stocks, a massive hit to the breeding herd in a very short period of time.

Pork Production Increasing Despite Setback

After two years of significant declines from pre-ASF levels, pork production within China is slated to increase for the first time in three years in 2021. Given the headwinds discussed previously in this article, there is some potential downward pressure on these estimates. Part of a driving force behind some of the fluctuations in pork production is the liquidation that occurs along with the outbreaks, which is reflected in an increase in pork production. The most recent update we have from USDA is for a 14% year-over-year increase in pork production in China, a number that could change with the next updated forecast. In addition to impacting pork production in the country, we have seen poultry production react to the shortages caused by ASF. Chicken production adjusted sharply upward in 2019, with increases continuing but slowing in 2020 and 2021. Current projections in chicken production are for a 2% increase in 2021, showing a softening of demand for this protein as pork production begins to recover.