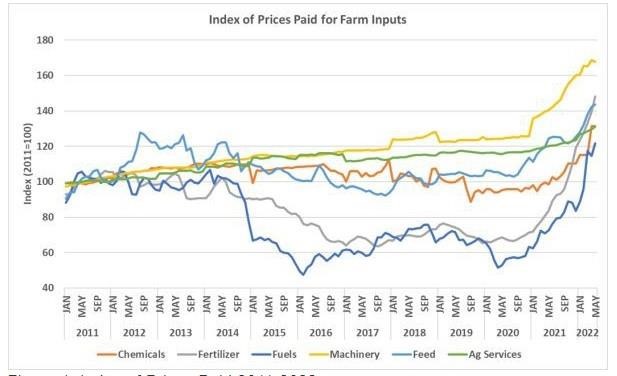

Figure 1. Index of Prices Paid 2011-2022

The first period, from 2011 to 2014, shows rather stable prices paid, with many of the indices in figure 1 hovering around the 90-110 mark (i.e. around 100 or the average 2011 price levels). Feed was the big exception during that period, increasing over 20% in 2012 as commodity prices of grains were at then record highs. This started to change in late 2014/early 2015 as prices dropped for all but machinery and agriculture services. In the case of fertilizer and fuel, the drop was substantial. For chemicals (insecticides, fungicides, and herbicides), prices fell slightly from 2014 levels back to or slightly below average 2011 levels. Machinery prices continued a slow and steady increase, while agriculture services remained relatively flat from 2015-2020. Many commodity grain prices were also at recent lows during that period.

The pandemic marked a major shift in these trends. Global supply chain disruptions created temporary logistical problems that impacted production and distribution of agricultural inputs. At the same time, increased global demand and tightening stocks of commodities affected global markets. As energy prices increased and conflict developed between Russia and the Ukraine, the prices of key inputs into agricultural production continued to rise. Rising inflation rates in the US are also a contributory factor, with the Bureau of Labor Statistics estimating a 9.06% year-over-year change in the consumer price index for June 2022. All inputs shown in figure 1 are now at least 20% higher than 2011 average levels, with fertilizer and feed costs 40% higher and machinery costs over 60% higher. For fertilizer costs, that is in sharp contrast to when they were more than 30% lower than 2011 average levels in 2017 and 2020.

Implications for Agriculture

The recent sharp increases in farm inputs have been a cause for concern. With inflation showing the largest gain since 1981, the Federal Reserve has already begun to increase interest rates. The Federal Funds rate has increased three times in 2022, 0.25% in March, 0.50% in May, and 0.75% in June. Increasing interest rates is a monetary policy the Federal Reserve uses to control inflation, and it is expected that future interest rate hikes will occur.

When interest rates increase, there is a direct impact on agricultural production because many producers rely on borrowing to cover both operating and ownership expenses. In a survey of agricultural lenders in the US, the Federal Reserve Bank of Kansas City reported an increase in non-real estate farm loans in early 2022 to cover operating expenses. The amount of real estate farm debt in mid- and large-sized loan portfolios also increased in early 2022. With higher costs of production, including higher interest rates on the horizon, farmers are faced with challenging decisions. While land values have continued to appreciate, using that capital to secure loans creates a risk for producers when the cost of borrowing increases through higher interest rates. This creates even more dependence on securing high prices for output to maintain margins.

As discussed in the Alabama Extension article Crop Prices Volatile in Advance of 2022 Harvest, a lot can change in just two weeks. Commodity market prices dropped between 9% and 21% during the last two weeks of June. A recent episode of the Alabama Crops Report Podcast discusses the impact of changes in acreage, the importance to lock in marketing opportunities, and some of the contributory factors to declining prices. Combine the increased input costs with declining prices and margins are looking to decrease.

It is unknown what impact the current increases in input costs and volatility in commodity prices will have on agriculture in Alabama. That is going to depend largely on a few factors, including how much output has been marketed at higher prices and how the weather ultimately impacts yields. The current financial condition in agriculture is one to be watching closely and considering risk management strategies is essential. Knowing when to lock in prices, where to adjust production inputs, and keeping tabs on cost of production through proper record keeping and financial analysis are always good management practices for producers to follow.

Source : aces.edu