Returning to the Higher-of

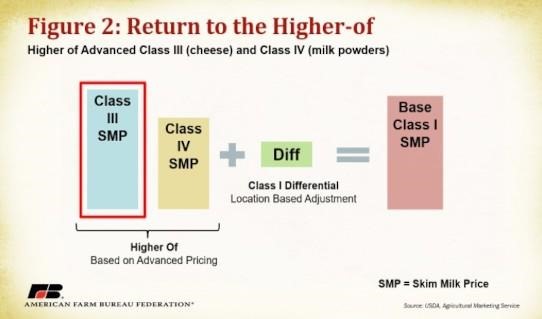

One of the major contenders for amending the Class I pricing formula is going back to the higher-of, which was used prior to the 2018 farm bill. Figure 2 displays the higher-of equation, which simply selects the higher price between Class III SMP and Class IV SMP. In the diagram example, the Class III SMP is higher and would be selected as the basis for the Class I SMP. The formula does not include a counterpart to the 74-cent adjustor of the current system and is often considered the easiest of the proposals to understand. It remains based on advanced prices which are calculated using values from the first two weeks of the preceding month.

Figure 3 displays a comparison of Class I prices between the current formula and the higher-of option (if it was in place) from January 2018 to present, all else held constant. During 2020, following government intervention in cheese markets and co-op level supply reduction programs, cheese prices sharply rose while milk powder prices only increased marginally. Under a higher-of alternative, producers would have been able to reap the benefits of record Class III prices since the formula would have been directly linked to the higher option and not subject to smoothing effects of a simple average. That said, if the Class III and IV SMP prices are close in value, the 74-cent adjustment component of the current method may result in a higher Class III SMP than the higher-of option. This is common prior to the onset of COVID market forces.

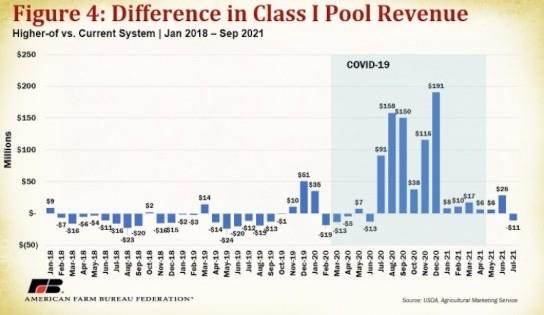

To estimate the impact on dairy farmer revenue, the difference in the Class I milk price between the current system and higher-of was multiplied by the Class I pool volume across all FMMOs. These calculations are presented in Figure 4. Between January 2018 and February 2020 (pre-COVID) the higher-of option would have provided positive Class I revenue pool benefits only 23% of the time. After February 2020, however, the higher-of would have provided over $785 million in Class I pool revenue benefits over the current system. Combined, this results in a $645 million revenue benefit of the higher-of over the current system within this timeframe. Consideration of this option must include the understanding of COVID’s unique marketplace effects, which resulted in massive pricing spreads the current pricing system could not adjust for. Expectations for large pricing spreads in the future keeps the higher-of option attractive.

National Milk Producers Federation Option

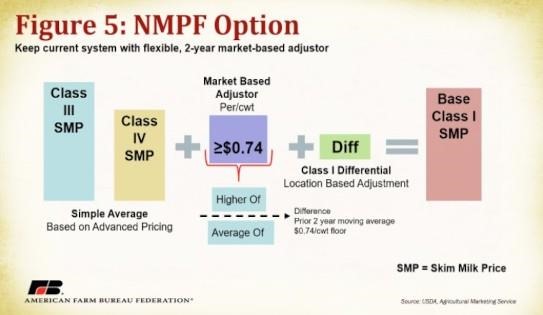

Another major contender for amending the Class I SMP pricing formula was designed by the National Milk Producers Federation (NMPF) on behalf of their member cooperatives. The option keeps the same general structure as the current system, including advanced pricing, but makes the 74-cent adjustor more market reactive. Instead of the 74 cents being fixed, the NMPF option would make 74 cents a floor and allow the adjustor to move above 74 cents. Using a calculation of the difference between the prior two-year (May-April) moving average of the higher-of and simple average of Class III SMP and Class IV SMP would determine whether the adjuster would rise above 74 cents. Based on this framework, the current 74-cent adjustor would rise to $1.63 for 2021-2023 to account for large price spreads during COVID-19.

Click here to see more...