We also have a strong fed cattle market to finish the year. Fed steer prices in the Southern Plains reached $195 in mid-December. Carcass weights remain very high compared to history. Steer dressed weights are near 960 pounds. Lower corn prices are supporting longer feeding periods, but there are typically seasonal declines in fed weights. It will be very interesting to watch cattle weights as 2025 begins.

2025 will begin as another year on the heels of herd contraction in the previous year. The USDA’s January 2025 Cattle Inventory Report is expected to confirm that cattle numbers did indeed decline in 2024. Weekly slaughter data from USDA support this projection. Year-to-date beef cow slaughter is down by 18%, but the implied cull rate—calculated as slaughter divided by inventories—remains at 10.2% for 2024, well above the that would indicate herd expansion. Heifer slaughter data also shows no signs of herd expansion. Year-to-date heifer slaughter is down 1.1%, with no evidence of heifer retention occurring at a rate sufficient to signal herd rebuilding.

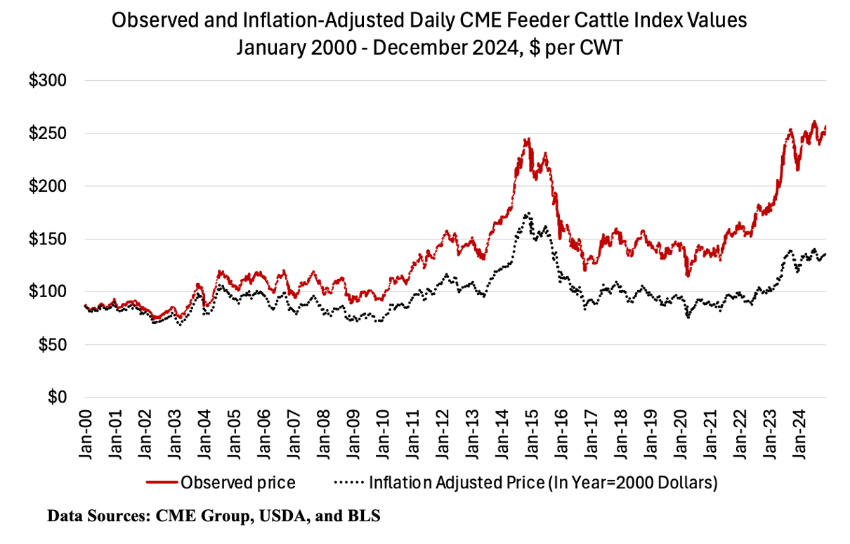

Cattle market fundamentals at the close of 2024 offer plenty of bullish signals for 2025. Many producers remember the high prices in 2014-2015 as a cautionary tale of how quickly prices can come down after a run up. However, the current fundamentals are quite different than they were in 2015. By year two of the 2014-2015 high price environment, it was clear that herd expansion was occurring. Currently, there are no clear signs to suggest larger calf supplies anytime soon. While prices are high, they have not yet hit levels to persuade producers to expand. 2024 prices hit record levels as shown in the chart above. However, after adjusting for inflation using 2000 as the base year, the purchasing power from the 2024 producer revenues was still below 2014-2015. It could very well be that feeder cattle prices have not yet peaked and the market is beginning 2025 with more optimism.

Source : osu.edu