By Gary Schnitkey, Krista Swanson, Jonathan Coppess, Nick Paulson

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Trade conflicts, prevented and late planting, and policy innovations have presented a difficult decision-making environment to farmers over the past several years. The decisions for this spring are now drastically complicated given the rapidly changing situation with the spread of COVID-19 and its attendant health threats and control measures. Currently, a paramount concern is continuing farming and livestock activities in the face of COVID-19 health threats and control measures. Farmers and input suppliers are coming up on a very busy planting season. To the extent possible, assuring a workplace free of COVD-19 is important. A US recession is expected to result because of COVID-19 control measures, the extent of which remains unknown. At this point, the economic implications are uncertain, but some sort of acreage and public policy response seems likely.

Health of Workforce

Health and public policy officials have advised extreme measures to slow the spread of COVID-19. In time, public officials will need to justify whether these measures were necessary and effective. Currently, taking health officials’ concerns at face value is prudent. That is, COVID-19 represents a serious public health threat.

The planting season in the Midwest is approaching. Crop farmers and input suppliers will soon be facing high workloads and need to perform tasks timely so as to avoid economic losses from delays. Obviously, planting is dependent on optimal season considerations and weather and cannot be postponed because of COVID-19.

The introduction of COVID-19 into the personnel of a farm or input supply firm will present difficulties, particularly given no other trained personnel are likely to be available. Many farmers are in the at-risk group being older and perhaps having other factors increasing risk. Working through a COVID-19 infection during planting likely is not wise, particularly given the reported death rates from COVID-19 in other countries. If possible, a COVID-19 free labor force needs to be maintained. As a result, farmers may wish to emphasize measures suggested by health officials: washing hands, limiting travel and social distancing.

Perhaps most critical will be those individuals providing input supply to other farmers. Seeds, fertilizer, and herbicides soon will be needed to be delivered to many farmers. Moreover, grains and livestock need to be transported to markets and processing destinations. The needs to limit COVID-19 spread among workers across these supply chains need to be considered and taken seriously.

Of course, the introduction of COVID-19 on farms with livestock or dairy would present extreme challenges. Again, practicing COVID-19 prevention seems prudent for livestock and dairy farms, obviously presenting managers with challenges.

Potential for Recession

Measures implemented to slow COVID-19 spread are expected to cause a recession, which could have large economic consequences. For example, a mild recession causing a 1 percent decline in GDP would have a cost of $214 billion. Based on recent estimates, the cost of a COVID-19 recession could exceed a trillion dollars in the U.S. under the most severe scenarios considered (i.e.

Brookings analysis) . The magnitude will depend on how long COVID-19 social distancing measures will be in place, the severity of the COVID-19 outbreak, and other general economic factors.

It is safe to say this recession would also negatively impact agriculture. Corn and soybean prices have fallen since COVID-19 measures have been put in place, roughly 6% for corn and 8% for soybeans. These percentage declines are based on a comparison of current future contract levels to projected prices for crop insurance. The projected price for corn in Midwest states is based on the February average of December 2020 corn futures contract prices on the Chicago Mercantile Exchange (CME). The corn projected price for 2020 is $3.88 per bushel. The price on March 16th was $3.66, a decline of 6% from the $3.88 projected price. The projected price for soybeans — the average of February settlement prices of the November 2019 CME soybean contract — is $9.17 per bushel. The settlement price on March 16th was $8.45, a decline of 8% from the February average.

Whether COVID-19 has larger impacts on corn and soybean prices in the future is an open question. Reduced travel will decrease fuel use, leading to less ethanol use, and potentially lower corn prices. Lower crude oil prices from Saudi – Russian exchanges also will play a role in corn prices. Chinese demand for soybeans is uncertain, particularly given that China could be harder hit by COVID-19 than the US. A Chinese recession would lower US soybean exports to China. Moreover, a major recession will impact livestock demand, which will have impacts on both corn and soybean prices. Farmdoc daily articles by Hubbs on March 16 and March 9 begin to address these issues, and further analyses in the future are likely.

Corn-Soybean Acreage Shifts

USDA projected 2020 plantings in the US at 94 million acres of corn, 85 million acres of soybeans, and 45 million acres of wheat (see farmdoc daily, March 10, 2020). Both corn and soybean acres in 2020 are projected to increase over 2019 levels, with projected 2020 corn acres the fourth highest since 1990. As in all years, actual planting will vary from projections.

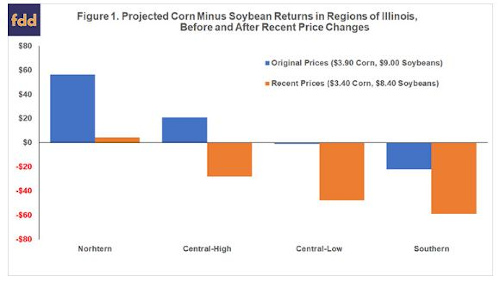

To gauge potential impact of price changes, projected profitability of corn and soybeans in Illinois were reevaluated with recent price changes. Corn-minus-soybean returns are projected for two scenarios in northern, central Illinois with high-productivity farmland (Central-High), central Illinois with low-productivity farmland (Central-Low) and southern Illinois. Original planning prices were $3.90 per bushel for corn and $9.00 per bushel for soybean. Blue bars in Figure 1 show corn-minus-soybean returns with original prices. Positive values indicate corn is more profitable than soybeans, and vice versa. Appendix Table 1 shows calculations, with yields and non-land coast coming from Illinois Crop Budgets released in January.

For a $3.90 corn price and a $9.00 soybean price, corn is projected more profitable than soybeans by $56 per acre in northern Illinois and $21 per acre in central Illinois on farms with high productivity farmland. Soybeans were projected more profitable than corn by $1 per acre on low-productivity farmland in central Illinois, and $22 per acre in southern Illinois. Profitability differences across Illinois are as expected. The original yields and prices were more favorable to corn production in northern and central-high regions and more favorable to soybean projection in southern Illinois.

Current fall bids in Illinois have been near $3.40 per bushel for corn and $8.10 per bushel for soybeans. Over all regions, these prices lower corn profitability more than soybean profitability (see orange bars in Figure 1). Corn still is projected more profitable than soybean in northern Illinois, but the difference is only $4 per acre. Soybeans are projected more profitable than corn by $28 per acre on high-productivity farmland in central Illinois, $48 per acre on low-productivity farmland in central Illinois, and $59 in southern Illinois.

Whether these price changes induce an acreage response is an open question. It was already difficult to predict acreage decisions for 2020 given the large number of prevent plant acres in 2019. How the presence of the 2019 prevent plant acres will impact 2020 acreages is an open question. Moreover, a large number of 2019 unharvested acres remain in North and South Dakota, which have a chance of becoming prevent plant acres this year.

Pricing Considerations

Markets have reacted erratically since the COVID-19 concerns have arisen, with equity markets having large percentage changes. Commodity prices are weak, at least by way of comparison to prices before COVID-19 concerns. A stage of panic exists in markets. As noted by Hubbs (farmdoc daily, March 16, 2020), prices could respond positively if the economic slowdown is relatively short-lived. Softness in prices could continue if a severe economic recession results. The former is more likely than the latter in the long-run. The question is in the timing of when will markets return to more normal behavior.

While markets are largely efficient, this situation is unique, and coming to terms with uncertainties will take some time. In this time period, expectations should be for erratic markets, leading to lower prices in the short-term.

Cash Flow and Policy Responses

Lower prices obviously have a negative impact on cash flow. Recent price changes lower projections of gross revenue by over $100 per acre in corn and $50 per acre in soybeans (see Appendix Table 1). Farmers may wish to be pro-active in talks with input suppliers, service providers, and landowners about COVID-19 impacts on farms. Communication appears key in this environment.

A federal policy response seems likely as a result of COVID-19. Both Congress and the Administration are considering various stimulus packages to counter COVID-19 impacts. For agriculture, policy responses should be focused on mitigating the financial damages done on farms due to the impacts of COVID-19 and responses to it, including the likely recession. Livestock and dairy farms could face workforce challenges, demand issues and problems with supply chains. All farmers will face market-based problems and the potential for issues in the supply chain.

Summary

The situation resulting from COVID-19 is fluid. Maintaining family and individual health, as well as a healthy workforce, is key at this point. Economic damages will result from COVID-19. The extent of those damages will depend on market responses. Some sort of policy response seems likely.