The 2025 U.S. corn crop remained historically very large with key revisions pointing to slightly lower production, small demand shifts, and slightly rising ending stocks; meanwhile, in soybeans lower inline yields was offset by lower exports. Let’ get into it!

USDA “pulls the rug under farmers” a kick the can down the road

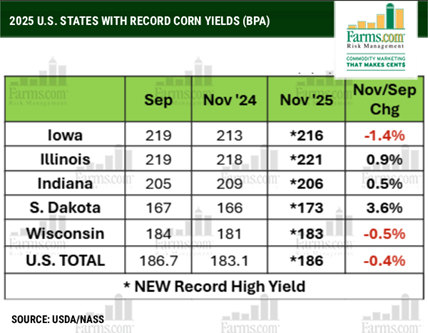

The USDA did lower the 2025 U.S. corn yield down to 186 vs. September’s projection at 186.7 down 0.7 but it was higher than the pre-report trade guess at 184 bpa. The U.S. soybean yield also dropped to 53 bpa vs. September at 53.5 down 0.5 bpa.

Despite the lower corn yields production still came in at a new record high at 16.742 billion bushels, due to 98.7 million acres planted -- 1.4 billion higher than last year! Farmers had a record corn yield in IA, IL, IN, WS and MN vs. last year with a record soybean yield in IA and IL despite the dry finish and extreme disease.

U.S. corn demand higher while soybeans lower

The U.S. corn export demand remains red hot only after 3-months into the marketing year up +66% vs. last year the best pace in 10 years forced the USDA to increase exports by 100 million to 3,075 billion bushels. Better demand more than offset lower yields to increase but higher 24/25 beginning stocks of 194 million bushels from the September 30th stocks report resulted in 25/26 U.S. corn ending stocks up by 44 million bushels to 2.154 billion bushels vs. September.

25/26 U.S. soybean exports were lowered by 50 million bushels to 1.635 billion bushels but lower 24/26 beginning stocks of 14 million bushels and lower yields resulted in lower 25/26 U.S. soybean ending stocks by 10 million bushels to 290 million vs. September at 300.

Higher than expected U.S. and global wheat supplies a surprise

USDA raised its production forecast by 58 million bushels, to 1.985 billion, driven by a record U.S. all-wheat yield at 53.3 bpa With domestic use left unchanged, ending stocks grew by 47 million bushels to 901 million! Global all wheat ending stocks also surged by 5.3 mmt to 271.43 vs. expected at 266.13 and last month at 264.06 with bigger production from all major wheat exporters.

USDA was not the farmer’s friend

The market was doing just fine without the USDA and common sense says if you did not have the available data from a U.S. government shutdown why not wait and provide a more transparent report. The typical October USDA harvested plot data where the corn and soybeans are weighed maybe sorely missed? However, the USDA could provide the farmer a “gift” like they did last year in the final January crop report with a lower-than-expected yield surprise.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit things; Farms.com Risk Management Website to subscribe to the program.