Beans have been on an up trend since registering a bottom on May 31st, which sat at $12.17 (for the August futures contract). There have been some corrections in recent days but much of that can be attributed to broader grain market malaise and slight tweaks to the near-term weather outlook.

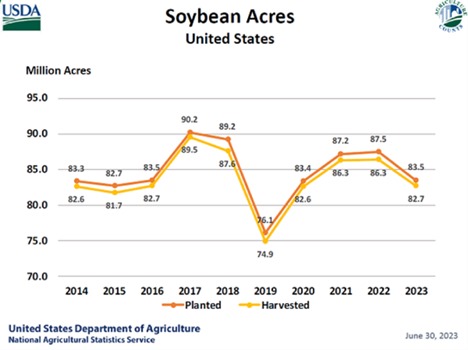

The USDA's estimation of soybean planted area for 2023, at 83.5 million acres, represents a 5% decline from the previous year. Furthermore, the planted acreage is down or unchanged in the majority of estimating states, with 21 out of 29 states reporting lower soybean cultivation. This significant reduction in acreage is a critical factor supporting soybean prices.

The forecasted soybean production for the U.S. in the 2023/24 season is 4.3 billion bushels (as of USDA’s July projections), showing a substantial decrease of 210 million bushels compared to the previous season. This drop is attributed to the lower harvested area rather than the yield, which remained unchanged as of July at 52 bushels per acre (although USDA could make downward adjustments in August and/or September). Consequently, soybean supplies for the 2023/24 season are projected to be reduced by 185 million bushels, tightening the market further.

On the demand side, the 2023/24 soybean crush estimate for the U.S. has been reduced by 10 million bushels versus USDA’s prior estimate in June, primarily due to a lower domestic disappearance forecast for soybean meal. Additionally, the 2023/24 U.S. soybean exports forecast was cut this month by 125 million bushels to 1.85 billion bushels. This decline in exports is influenced by reduced U.S. supplies and lower global imports. Taken together, these factors contribute to a decrease in the ending stocks for the 2023/24 season, projected to be 300 million bushels, representing a decrease of 50 million bushels from the previous month's estimate.

While the reduced acreage and production have provided support to soybean prices, the weather conditions in August pose a potential risk to the soybean market. Heat is expected to end July and through the beginning of August to add to an already drought-stricken U.S. This will have a negative impact on crop development and yield as soybeans are an August crop.

The combination of reduced acreage, lower production estimates, and potential weather challenges has created a bullish scenario for soybean prices. With lower supplies and strong demand from both domestic and international markets, soybean prices are likely to remain well supported in the near term.