Consumers looking for value have already begun to seek lower-value cuts of meat, avoiding branded and moving to private label alternatives at retail, and limiting food service purchases.

In anticipation of some seasonal demand strength, processors have built inventory to satisfy a modest rebound in Q4 2022. However, it is expected that the upcoming holiday sales will test the market’s resilience and ability to absorb premiums.

The lower gross domestic product (GDP) growth expectations in 2023 will also limit market needs, slow herd-rebuilding efforts, and impact trade volumes in Q4 2022 and early 2023.

The expected weaker economic growth will also affect trade volumes in Q4 2022 and early 2023.

In Q3 2022, higher pork prices in key exporting nations limited pork’s competitiveness, but pork shipments to most markets were relatively strong through the quarter, with local supplies insufficient to satisfy demand in key markets in South Korea, Japan, and Mexico.

Disappointing shipments into China and a lack of clarity around the prospects for improvement given ongoing Covid-related restrictions have forced other markets to absorb the excess.

“Efforts to stabilize production in some regions have been slow due to productivity challenges and consumer uncertainty, resulting in improved trade prospects for 2023,” said Christine McCracken, Senior Analyst – Animal Protein at Rabobank. “Moreover, recent price setbacks and government interventions to stabilize food prices could work to strengthen demand.”

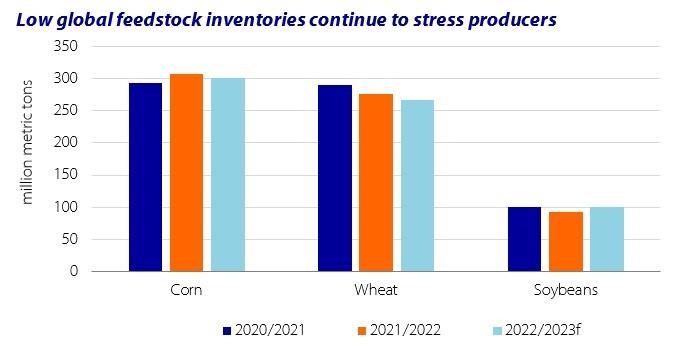

Other elements impacting the pork industry include higher feed costs, remaining near record levels following less-than-ideal harvests of grain and oilseed in the US, parts of Europe, and Asia.

The Rabobank report suggested that the acreage of corn and soybean planted in the southern hemisphere could ease feed concerns, but not eliminate them.

Supply chain disruptions remain a challenge for the industry—all industries, in fact—which adds to feed costs and volatility.

The competition for reduced grain and oilseed inventories and the resulting price increases are compounding challenges producers face from labour and energy costs.

The report said that producer growth plans remain muted in most regions, with limited growth in the sow herd expected to curb 2023 global pork production.

“With few prospects for cost relief and limited visibility around the strength of consumer demand given the challenging economic environment in 2023, producers have scaled back plans to add to their herds,” summed up McCracken. “Global production is expected to fall [by] two percent in 2022 and see almost no material growth in 2023, with production in key growing regions significantly lower."