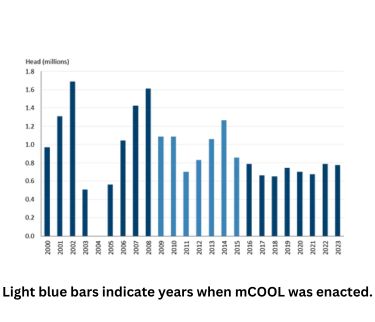

This ruling marks the latest development in the two-decade-long debate over country-of-origin labeling, following the repeal of mandatory labeling requirements (mCOOL) in 2015.

Though voluntary, Farm Credit Canada (FCC) advises that the new vCOOL guidelines may create challenges for Canadian livestock exporters. Annually, Canada exports around four million young piglets (under seven kilograms and 21 days old) to the United States.

Despite spending most of their lives in the U.S., these animals would no longer qualify for the “Product of USA” label under the new rule, potentially disrupting their marketability.

Some industry sources anticipate that meat processors may begin adopting the new labeling standards as early as mid-2025, ahead of the official deadline.

FCC advises that while Canadian live animal exports to the U.S. are expected to continue, the ruling may impact pricing dynamics, particularly basis levels (the spread between cash and futures prices) for cattle and hog exports.

Additionally, the ruling could pose challenges for processed meat exports, as Canadian hog producers face tighter margins due to declining domestic processing capacity and increased reliance on U.S. slaughter facilities.

Estimating the financial impact of vCOOL remains difficult, but previous mCOOL policies were found by the WTO to cost over $1 billion USD annually in lost revenue for Canadian producers, according to Farm Credit Canada.

It remains uncertain if U.S. pork industry stakeholders will advocate for Canadian piglet imports, given that Canada’s exports account for 20% of its total hog production but only 5% of the U.S. slaughter volume.

However, the highly integrated nature of North American livestock industries may drive support for relaxed labeling standards, particularly for animals that spend the majority of their lives in the U.S.

FCC advises that ultimately, the impact of vCOOL will depend on U.S. consumer preferences. North American beef and pork markets are closely linked, and the new labeling could shift trade patterns and add costs, with consumer willingness to pay potentially playing a pivotal role as meat prices remain high.

Photo Credit: Pexels-Diana-DSSS